What's Happening?

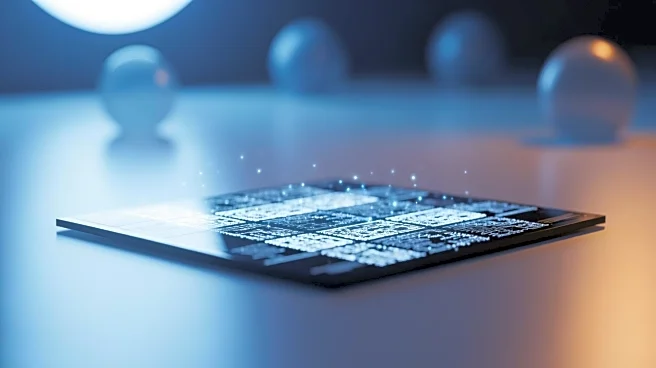

Taiwan Semiconductor Manufacturing Company (TSMC) announced plans to increase its capital spending by nearly 40% this year, following a 35% rise in net profit for the latest quarter. The company, a key supplier to tech giants like Nvidia and Apple, reported a net profit of NT$506 billion ($16 billion) for the October-December period. TSMC's revenue also saw a 21% increase, reflecting its strong position in the AI-driven market. The company has committed to investing around $165 billion in the U.S., accelerating the construction of new plants in Arizona to meet client demand.

Why It's Important?

TSMC's expansion plans highlight the growing importance of semiconductors in the AI sector, which is becoming increasingly integral to various industries. The company's investment

in the U.S. is part of a broader strategy to secure its position in the global market amid geopolitical tensions and supply chain challenges. This move could have significant implications for the U.S. economy, potentially boosting job creation and technological innovation. TSMC's actions may also influence other companies in the semiconductor industry, prompting further investments and strategic shifts.

What's Next?

TSMC's increased capital expenditure is expected to support its growth in the AI sector, with spending projected to reach $52 billion-$56 billion by 2026. The company will likely continue to face challenges related to cost management and geopolitical pressures. The U.S. government may implement additional measures to encourage domestic production, potentially affecting TSMC's strategic decisions. Industry analysts will be monitoring TSMC's performance and investment strategies, as they could have far-reaching effects on the global semiconductor market.