What's Happening?

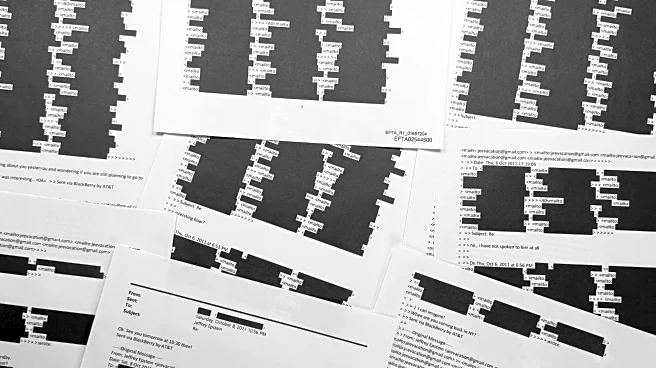

Pomerantz LLP has initiated an investigation into Apollo Global Management, Inc. regarding potential securities fraud or other unlawful business practices. This investigation follows a report by the Financial Times, which revealed that top executives at Apollo, including CEO Marc Rowan, engaged in discussions about the firm's tax arrangements with Jeffrey Epstein throughout the 2010s. Despite Apollo's previous statements denying any business dealings with Epstein, these revelations have raised concerns about the company's transparency and governance. As a result of this news, Apollo's stock price experienced a significant drop, falling by $7.69 per share, or 5.72%, closing at $126.85 on February 3, 2026.

Why It's Important?

The investigation into Apollo Global Management

is significant as it highlights potential governance issues within one of the largest private equity firms in the world. If the allegations of securities fraud are substantiated, it could lead to substantial financial penalties and damage to Apollo's reputation. This situation underscores the importance of transparency and ethical practices in maintaining investor trust and market stability. The outcome of this investigation could have broader implications for the private equity industry, potentially prompting increased regulatory scrutiny and calls for more stringent compliance measures.

What's Next?

As the investigation by Pomerantz LLP progresses, investors and stakeholders will be closely monitoring any developments. If evidence of wrongdoing is found, it could lead to class-action lawsuits and regulatory actions against Apollo. The firm may also face pressure to implement governance reforms to restore investor confidence. Additionally, other private equity firms may take proactive steps to review their own practices to avoid similar scrutiny. The financial markets will be watching for any further impact on Apollo's stock price and overall market perception.