What's Happening?

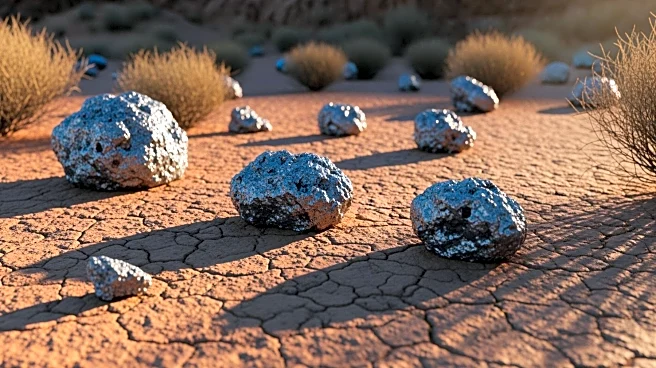

Ryzon Materials, an ASX-listed company, has entered into a nonbinding heads of agreement with Yintai Xinhai Mining to develop an engineering, procurement, and construction management (EPCM) solution for the Nachu graphite project in Tanzania. Xinhai will utilize its expertise in mining engineering and mineral processing to enhance project efficiency and mitigate execution risks. The agreement outlines steps towards finalizing an EPCM contract, with Xinhai providing cost estimates for an 80,000 t/y plant. The company is also assisting Ryzon in securing financing, primarily through debt funding from Chinese sources. Xinhai's chairperson, Professor Elon Zhang, expressed confidence in the project's potential, while Ryzon's chairperson, Frank Poullas,

highlighted the ongoing support from Xinhai.

Why It's Important?

The partnership between Ryzon and Xinhai is significant for the development of the Nachu graphite project, which could enhance the supply of graphite, a critical mineral for various industries, including electric vehicles and renewable energy. The collaboration aims to streamline project execution and reduce risks, potentially accelerating the project's timeline. The focus on securing financing from Chinese sources underscores the strategic importance of international partnerships in resource development. Successful execution of this project could position Ryzon and Xinhai as key players in the global graphite market, impacting supply chains and pricing dynamics.

What's Next?

Ryzon and Xinhai are expected to finalize the EPCM contract in the coming months, with Xinhai providing a detailed proposal in the second quarter. The companies will continue to work on securing financing, with a significant portion expected to come from Chinese debt funding. As the project progresses, stakeholders will likely monitor developments closely, including potential environmental and regulatory considerations. The successful advancement of the Nachu project could lead to further collaborations between Ryzon and Xinhai, as well as increased interest from other international investors in the Tanzanian mining sector.