What's Happening?

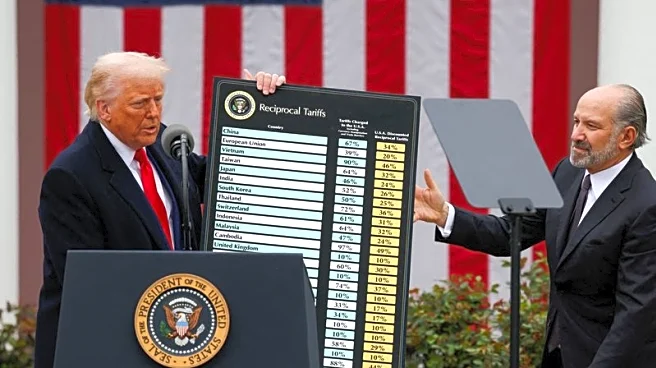

The U.S. government could owe more than $175 billion in refunds to importers following the Supreme Court's decision that President Trump's tariffs were imposed illegally. The ruling, which found that the tariffs were enacted without congressional authorization under the International Emergency Economic Powers Act, has significant financial implications. The Penn-Wharton Budget Model estimates the potential refunds, highlighting the logistical challenges of processing these repayments. The decision has sparked concerns about the impact on trade agreements and the broader economic landscape.

Why It's Important?

The Supreme Court's ruling could lead to substantial financial liabilities for the U.S. government, affecting budgetary planning and economic policy. The potential

refunds represent a significant portion of the tariffs collected, which have been a key element of Trump's trade strategy. The decision may also influence future trade negotiations and the use of tariffs as a policy tool. The ruling underscores the legal and constitutional limits of presidential authority in trade matters, potentially prompting legislative action to address these issues.

What's Next?

The process of refunding tariffs is expected to be complex and lengthy, with significant financial implications for businesses and the government. The administration may seek to impose tariffs under other legal authorities, potentially leading to new trade tensions. The ruling may also prompt further legal challenges and discussions about the role of tariffs in U.S. trade policy. Stakeholders, including businesses and trade partners, will be closely monitoring the administration's next steps and any potential changes in trade policy.