What's Happening?

Norris Perne & French LLP MI has increased its holdings in Taiwan Semiconductor Manufacturing Company Ltd. (TSMC) by 8.3% during the third quarter, as reported in their latest Form 13F filing with the Securities

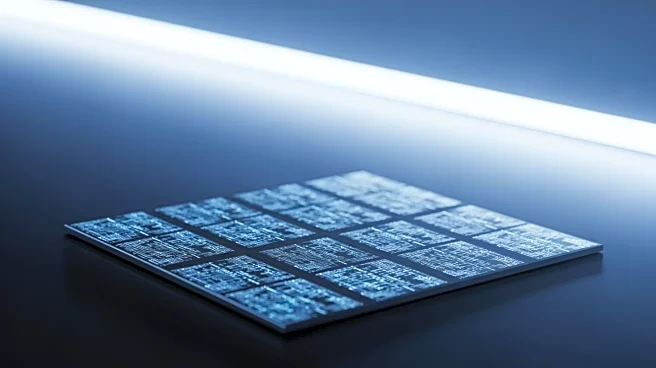

and Exchange Commission. The firm now owns 152,598 shares of TSMC, making it the sixth largest holding in their investment portfolio, valued at $42,619,000. This move is part of a broader trend among institutional investors who are increasing their stakes in TSMC, reflecting confidence in the company's growth potential. TSMC, a leading semiconductor foundry, has also announced an increase in its quarterly dividend to $0.9678 per share, up from $0.83, indicating strong financial performance and shareholder returns.

Why It's Important?

The increased investment by Norris Perne & French LLP MI in TSMC underscores the growing importance of the semiconductor industry, particularly as global demand for chips continues to rise. TSMC's role as a major supplier in the semiconductor market positions it as a critical player in the technology supply chain, impacting various sectors including consumer electronics, automotive, and telecommunications. The firm's decision to boost its holdings reflects confidence in TSMC's ability to capitalize on these market opportunities, potentially leading to significant returns for investors. Additionally, the dividend increase signals robust financial health and a commitment to rewarding shareholders, which could attract further investment.

What's Next?

As TSMC continues to expand its production capabilities and invest in advanced technologies, it is likely to maintain its competitive edge in the semiconductor industry. The company's financial performance and strategic initiatives will be closely watched by investors and analysts, particularly in light of ongoing global supply chain challenges. Future developments in TSMC's business operations, such as new partnerships or technological advancements, could further influence its stock performance and investor sentiment.