What's Happening?

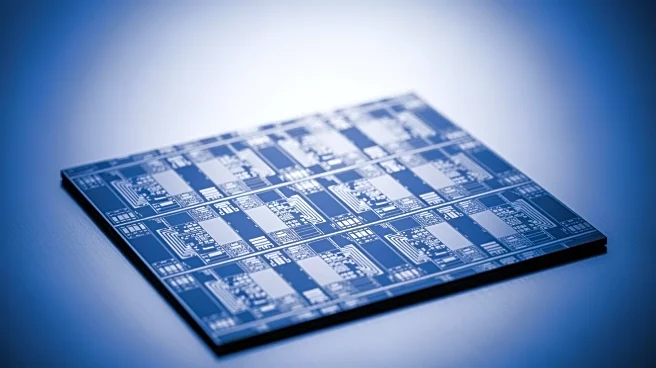

Krilogy Financial LLC has recently acquired a new position in Taiwan Semiconductor Manufacturing Company Ltd. (TSMC), purchasing 1,763 shares valued at approximately $518,000. This move, disclosed in a filing with the Securities and Exchange Commission, reflects a growing interest in the semiconductor industry. Other institutional investors have also adjusted their holdings in TSMC, with Westfuller Advisors LLC, BankPlus Wealth Management LLC, and others increasing their stakes. TSMC, a leading semiconductor foundry, has been a focal point for investors due to its significant role in global chip production. The company's stock has been rated as a 'buy' by several analysts, with a consensus price target of $391.43, indicating positive market

sentiment.

Why It's Important?

The acquisition by Krilogy Financial LLC and other institutional investors underscores the strategic importance of TSMC in the semiconductor industry. As a major player in chip manufacturing, TSMC's performance is critical to the supply chain of numerous technology sectors, including mobile, high-performance computing, and AI applications. The increased investment reflects confidence in TSMC's ability to maintain its market leadership and capitalize on the growing demand for semiconductors. This trend is significant for the U.S. economy, as it highlights the reliance on global semiconductor supply chains and the potential impact on technology and manufacturing sectors.

What's Next?

With TSMC's stock receiving strong buy ratings from multiple analysts, the company is expected to continue its growth trajectory. The semiconductor industry is poised for expansion, driven by advancements in technology and increased demand for electronic devices. TSMC's strategic investments in advanced nodes and specialty processes position it well to meet future market needs. Investors will likely monitor TSMC's financial performance and strategic initiatives closely, as these will influence the broader semiconductor market and related industries.