What's Happening?

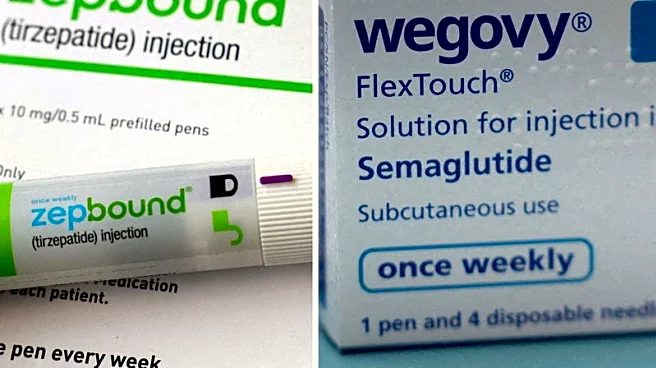

Novo Nordisk and Eli Lilly are set to introduce new obesity pills in 2026, marking a significant shift in the GLP-1 market, which has been dominated by weekly injections. These pills, including Novo Nordisk's once-daily Wegovy and Eli Lilly's upcoming orforglipron, offer a more convenient alternative for patients who are needle-averse or do not perceive their condition as severe enough for injections. The pills are expected to attract new patients to obesity treatment, potentially expanding the market and boosting sales for both companies. Analysts predict that by 2030, pills could capture about 24% of the global weight-loss drug market, valued at approximately $22 billion.

Why It's Important?

The introduction of obesity pills could significantly impact the U.S.

healthcare landscape by making weight-loss treatments more accessible and acceptable to a broader audience. This development could lead to increased market penetration and sales for pharmaceutical giants like Novo Nordisk and Eli Lilly. Additionally, the convenience and potentially lower cost of pills compared to injections may encourage more patients to seek treatment, thereby expanding the market. However, the pills' effectiveness compared to injections remains a point of consideration, as injections have shown higher efficacy in clinical trials.

What's Next?

As Novo Nordisk and Eli Lilly prepare to launch their obesity pills, the market is poised for increased competition. Eli Lilly's orforglipron is expected to enter the market within months, potentially leading to a sales rivalry with Novo Nordisk's Wegovy pill. The companies will likely focus on marketing strategies to highlight the convenience and benefits of their respective products. Additionally, the impact on insurance coverage and pricing strategies will be crucial as these pills become available to consumers.