What's Happening?

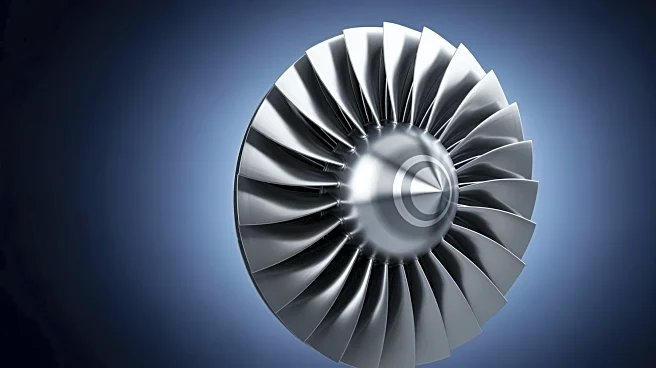

GE Aerospace's stock is approaching its 52-week high, driven by a series of operational updates and positive analyst forecasts. The stock recently fluctuated, dropping to $292.18 before rebounding to $301.69, and is currently trading around $307.21. This movement comes amid a new FAA airworthiness directive affecting the LEAP-1A engine program, which requires inspections and potential part replacements due to reported in-flight shutdowns. Additionally, GE Aerospace has announced a quarterly dividend and secured a defense contract for LM2500 engines for U.S. Navy destroyers. The company is also investing in manufacturing expansions in the UK and the U.S. to address engine supply constraints.

Why It's Important?

The developments at GE Aerospace are significant for

investors and the aerospace industry. The FAA directive could impact operational efficiency for airlines using the LEAP-1A engines, potentially increasing service demands and costs. However, this also presents an opportunity for GE to capitalize on increased aftermarket services. The defense contract and manufacturing investments highlight GE's strategic focus on long-term growth and capacity expansion. Analyst optimism, with price targets reaching as high as $386, suggests confidence in GE's ability to leverage aerospace and defense trends, potentially positioning the company for substantial market cap growth.

What's Next?

Looking ahead, GE Aerospace is set to release its fourth-quarter earnings on January 22, 2026. Investors will be keen to see updates on 2026 demand forecasts, LEAP engine durability, and margin trajectories. The company's ability to manage regulatory challenges and sustain growth in engine deliveries will be critical. Additionally, the broader aerospace supply chain's stability and geopolitical factors, such as U.S.-China relations, will influence GE's performance. The FAA directive's impact on airline operations and GE's service revenues will also be closely monitored.