What's Happening?

Zephyr Energy PLC has reported a substantial increase in hydrocarbon production from its non-operated portfolio in the third quarter of 2025. The company's average net production rose to 925 barrels of oil equivalent per day, up from 632 in the previous quarter. This growth was driven by a $7.3 million acquisition of producing assets and the restart of six previously shut-in wells. Zephyr's portfolio now includes interests in over 600 gross wells across several U.S. states, providing a diverse range of production opportunities. The company also successfully renewed its revolving credit facility at a lower interest rate, supporting its strategic growth initiatives.

Why It's Important?

Zephyr Energy's production growth highlights its effective portfolio management

and strategic acquisitions, which are crucial for sustaining and enhancing its market position. The increase in production not only boosts the company's revenue potential but also strengthens its operational capabilities in the competitive U.S. oil and gas sector. This development is particularly relevant as it reflects the company's resilience and adaptability in a fluctuating energy market. Investors and stakeholders are likely to view this growth as a positive indicator of the company's future prospects and financial stability.

What's Next?

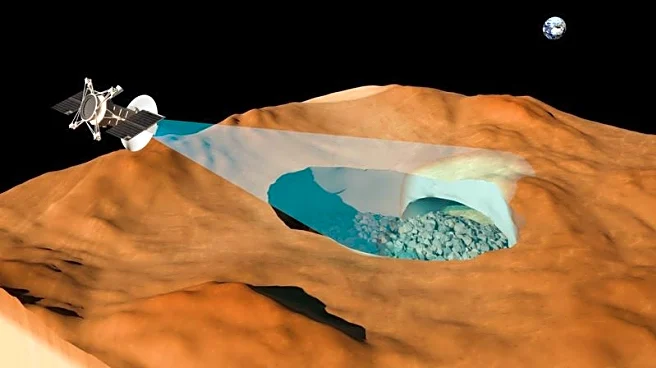

Looking ahead, Zephyr Energy plans to continue expanding its non-operated portfolio and enhancing its production capabilities. The company is also focused on accelerating development activities in the Paradox Basin, Utah, which is expected to contribute significantly to its growth in 2026. Ongoing discussions and rising interest in Western U.S. oil and gas markets may further support Zephyr's strategic objectives. The company's ability to capitalize on these opportunities will be critical in maintaining its competitive edge and delivering value to shareholders.