What's Happening?

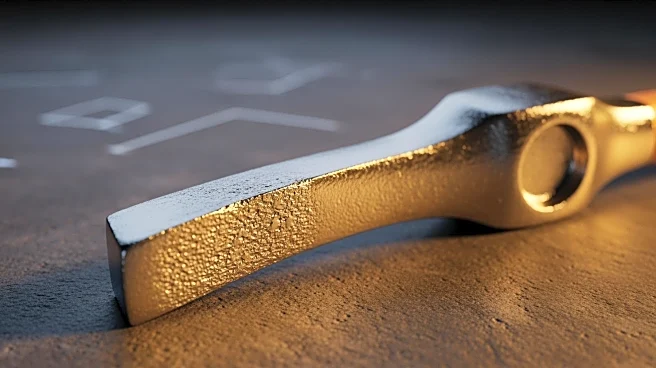

Aditya Ispat, a steel manufacturer, reported significant financial losses in its Q3 FY26 results, highlighting ongoing operational challenges. The company recorded a net loss of ₹0.44 crore, which, although an improvement from previous quarters, underscores persistent issues. Net sales fell by 29.82% year-on-year to ₹8.19 crore, reflecting weak demand and competitive pressures in the bright steel bar segment. The operating margin remained negative at -1.47%, marking the highest margin in the past seven quarters. The company's financial distress is further exacerbated by a high debt burden, with a debt-to-equity ratio of 1.59 times, and a negative return on equity of -27.50%. These figures indicate severe capital erosion and operational inefficiencies.

Why It's Important?

The financial struggles of Aditya Ispat are indicative of broader challenges faced by smaller players in the iron and steel sector, particularly those lacking scale and diversification. The company's inability to maintain profitability amid volatile raw material prices and intense competition highlights the vulnerability of niche market players. This situation could lead to further market consolidation as smaller firms struggle to survive. For stakeholders, including investors and creditors, the company's high leverage and negative profitability raise concerns about its long-term viability and ability to service debt. The lack of institutional investment further signals a lack of confidence in the company's recovery prospects.

What's Next?

Aditya Ispat's future hinges on its ability to address operational inefficiencies and improve financial performance. Potential steps include restructuring to reduce debt, seeking strategic partnerships, or capital infusion to modernize operations. However, the absence of institutional investors and limited promoter stake suggest that significant changes are not imminent. The company must focus on achieving positive operating margins and revenue growth to regain market confidence. Monitoring upcoming quarterly results for signs of improvement will be crucial for stakeholders.

Beyond the Headlines

The challenges faced by Aditya Ispat also reflect broader industry trends, where smaller firms are increasingly squeezed by larger, integrated competitors. The company's focus on a niche product with limited pricing power exacerbates its vulnerability to market fluctuations. Additionally, the high debt levels and negative returns on equity highlight the risks associated with high leverage in capital-intensive industries. This situation underscores the importance of strategic financial management and operational efficiency in maintaining competitiveness.