What's Happening?

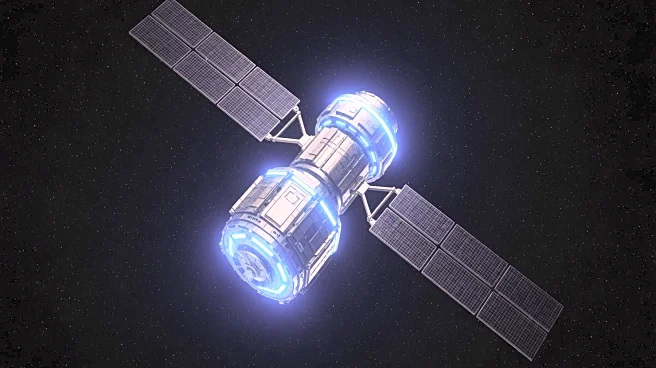

AST SpaceMobile's stock experienced a significant increase, closing up 14.9% at $83.47, driven by investor optimism surrounding the company's BlueBird 6 satellite rollout. The company plans to launch 45-60 satellites by the end of 2026, with a launch cadence of every one to two months. The BlueBird 6 satellite, which launched on December 23, 2025, is part of AST's next-generation satellite series, featuring an array spanning nearly 2,400 square feet. This development is crucial as AST aims to provide direct-to-cell service, connecting ordinary smartphones to satellites without the need for special devices. The company has partnered with major telecom operators, including Vodafone, to expand its network and deliver coverage for mobile operators.

Why It's Important?

The surge in AST SpaceMobile's stock reflects growing investor confidence in the company's ability to execute its ambitious satellite deployment plan. The direct-to-cell service technology has the potential to revolutionize mobile connectivity by providing coverage in remote areas and serving as a backup during disasters and outages. This could significantly impact the telecommunications industry, offering new opportunities for mobile operators to enhance their service offerings. Additionally, the competition in the satellite-to-phone connectivity market is intensifying, with companies like SpaceX's Starlink also pursuing similar partnerships. AST's success in this area could position it as a leader in the emerging market for satellite-based mobile connectivity.

What's Next?

Investors will be closely monitoring AST SpaceMobile's ability to maintain its stock gains and execute its satellite launch schedule. The company's next earnings report, expected on March 2, 2026, will provide further insights into its progress and financial health. Key areas of focus will include updates on launch cadence, satellite commissioning timelines, and cash flow management. Additionally, macroeconomic factors, such as U.S. interest rate policies and upcoming economic reports, could influence investor sentiment and trading conditions. The company's ability to secure and expand partnerships with telecom operators will also be critical in maintaining its competitive edge in the satellite-to-phone connectivity market.