What's Happening?

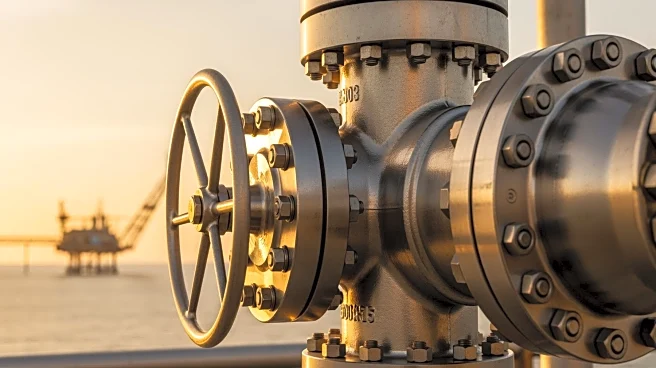

Delfin Midstream is progressing towards a final investment decision (FID) for its Delfin LNG project, a floating liquefied natural gas (LNG) development linked to a deepwater port offshore Louisiana. The company has extended a letter of award with Samsung Heavy Industries (SHI) and placed orders for critical liquefaction equipment. This move follows early engagement work and is part of the final steps needed to reach FID, expected in February 2026. Additionally, Delfin has entered into a letter of award with Black & Veatch to execute a purchase order with Siemens Energy for gas turbine mechanical drive packages. The project, which plans to produce up to 13 million tonnes of LNG annually, represents a significant milestone in U.S. energy infrastructure

development.

Why It's Important?

The Delfin LNG project is poised to become the first offshore LNG export deepwater port facility in the United States, marking a significant advancement in the country's energy export capabilities. This development could enhance the U.S.'s position in the global LNG market, potentially increasing energy exports and contributing to economic growth. The project also underscores the strategic importance of LNG as a cleaner energy source, aligning with broader energy transition goals. Stakeholders in the energy sector, including equipment manufacturers and engineering firms, stand to benefit from the project's execution.

What's Next?

Delfin Midstream is expected to make a final investment decision by February 2026, which will trigger the immediate execution of the project. The company has already secured manufacturing slots for key components to ensure the project remains on schedule. As the project progresses, it will likely attract attention from environmental groups and regulatory bodies, given its offshore location and potential environmental impacts. The successful completion of the project could lead to further investments in similar offshore LNG facilities.