What's Happening?

Saks Global, the parent company of Saks Fifth Avenue, is reportedly preparing to file for bankruptcy after failing to make a $100 million interest payment on its bonds. This financial difficulty is linked to the company's acquisition of Neiman Marcus. Saks Global has been struggling with declining demand in the U.S. due to rising inflation and a weakening labor market, which have reduced discretionary spending on luxury items. In an effort to manage its debt, the company has attempted to sell a minority stake in Bergdorf Goodman and other assets. Despite a debt restructuring in August 2025, which included $600 million in new funds, the company continues to face financial challenges.

Why It's Important?

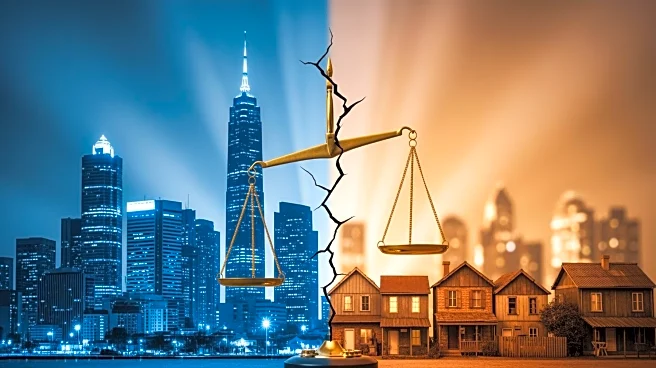

The potential bankruptcy of Saks Global highlights the ongoing

challenges faced by the retail sector, particularly in the luxury market. Rising inflation and economic uncertainty have dampened consumer spending, impacting retailers' revenues and financial stability. The situation underscores the broader economic pressures affecting businesses and consumers alike. For Saks Global, bankruptcy could lead to significant restructuring, affecting employees, creditors, and the retail landscape. The company's financial struggles also reflect the difficulties in sustaining high-end retail operations amid changing consumer behaviors and economic conditions.

What's Next?

As Saks Global negotiates with creditors to secure financing for the bankruptcy process, the outcome will likely involve significant restructuring efforts. This could include asset sales, operational changes, and potential layoffs. The company's ability to navigate these challenges will be crucial in determining its future viability. Additionally, the situation may prompt other luxury retailers to reassess their strategies in response to economic pressures. Stakeholders, including investors and employees, will be closely monitoring developments as the company moves forward with its bankruptcy plans.