What's Happening?

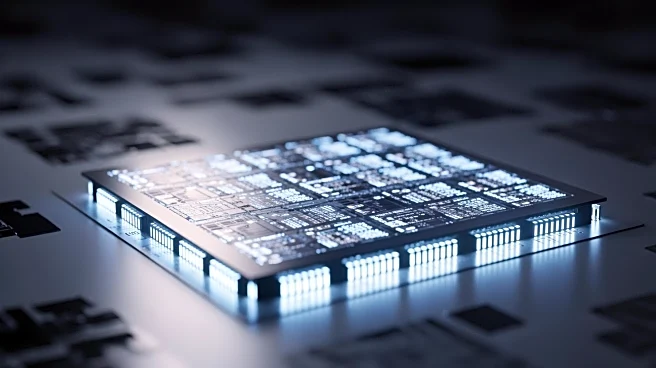

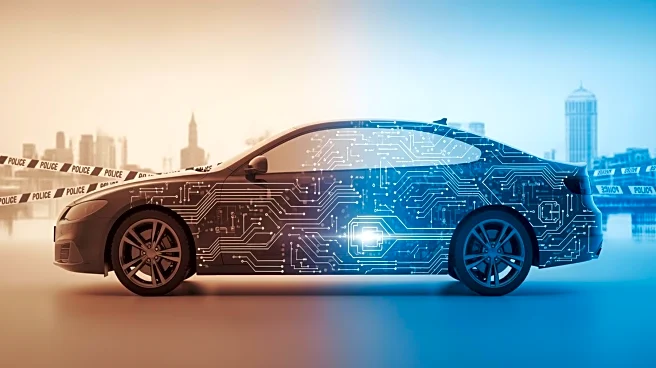

Taiwan Semiconductor Manufacturing Company Limited (TSMC) has reported a substantial increase in its revenue for January 2026. The company announced a consolidated net revenue of NT$401.26 billion, marking a 19.8% rise from December 2025 and a 36.8% increase compared to January 2025. This growth is attributed to the company's strategic advancements in semiconductor technology, particularly in the production of advanced 3-nanometre chips. TSMC is planning to commence mass production of these chips in Kumamoto, Japan, which are crucial for high-performance computing (HPC) and artificial intelligence (AI) servers. Additionally, TSMC's board has approved a cash dividend of NT$6.0 per share for the fourth quarter of 2025.

Why It's Important?

The reported revenue growth

underscores TSMC's pivotal role in the global semiconductor industry, particularly as demand for advanced chips continues to rise. The company's expansion into Japan for 3-nanometre chip production not only strengthens its market position but also contributes to local economic growth and supports Japan's AI business infrastructure. This development is significant for the U.S. as TSMC's advancements align with the onshoring trend and the strategic importance of semiconductor manufacturing in national security and technological leadership. The growth in TSMC's revenue and its strategic investments could influence U.S. tech companies reliant on advanced semiconductors, potentially affecting supply chains and innovation in AI and HPC sectors.

What's Next?

TSMC's continued expansion and technological advancements are likely to maintain its competitive edge in the semiconductor industry. The company's plans to produce 3-nanometre chips in Arizona next year could further solidify its presence in the U.S. market, potentially leading to more collaborations with American tech firms. Stakeholders, including investors and tech companies, will be closely monitoring TSMC's production capabilities and market strategies, as these could impact global semiconductor supply and pricing. Additionally, the geopolitical implications of TSMC's operations in Japan and the U.S. may influence future trade policies and international relations in the tech sector.