What's Happening?

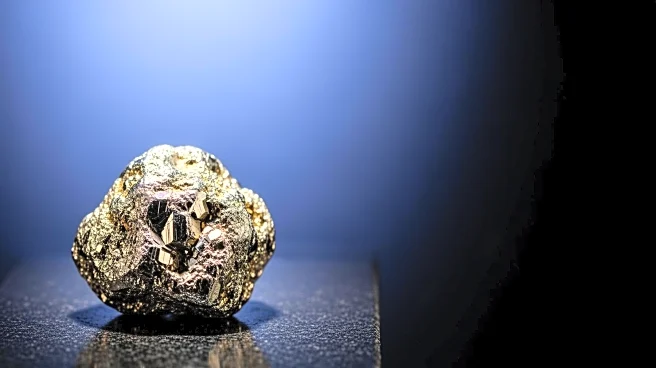

HudBay Minerals Inc., a diversified mining company, has seen an increase in its FY2025 earnings per share (EPS) forecast by Paradigm Capital. Analyst J. Woolley has revised the EPS estimate from $0.79 to $0.84, reflecting a positive outlook for the company. This adjustment follows HudBay's recent quarterly earnings report, which showed a net margin of 13.13% and a return on equity of 10.73%. Despite missing the consensus EPS estimate for the quarter, HudBay's revenue was reported at $346.80 million, a decrease from the previous year. The company has received various ratings from analysts, including a 'buy' rating from Goldman Sachs and an 'outperform' rating from Raymond James Financial. HudBay Minerals focuses on the exploration and development

of mining properties in North and South America, producing copper, gold, silver, and other minerals.

Why It's Important?

The revised EPS forecast for HudBay Minerals suggests a positive trajectory for the company, which could influence investor confidence and stock performance. Analysts' ratings, including multiple 'buy' recommendations, indicate strong market sentiment towards HudBay's potential growth. The company's strategic focus on diversified mining operations positions it well to capitalize on demand for minerals like copper and gold, which are critical for various industries, including technology and manufacturing. Institutional investors have shown interest, with significant stakes acquired by entities like GMT Capital Corp and Hancock Prospecting Pty Ltd. This institutional backing further underscores the company's potential for growth and stability in the mining sector.

What's Next?

HudBay Minerals is expected to continue its focus on optimizing its mining operations and exploring new opportunities in North and South America. Analysts have projected further earnings growth in the coming years, with estimates for FY2026 and FY2027 showing significant increases. The company's ability to meet these projections will depend on its operational efficiency and market conditions for its mineral products. Stakeholders, including institutional investors and analysts, will likely monitor HudBay's performance closely, particularly in light of its strategic initiatives and market dynamics.

Beyond the Headlines

The mining industry faces challenges such as fluctuating commodity prices and environmental concerns. HudBay Minerals' operations in North and South America may be impacted by regulatory changes and sustainability pressures. The company's ability to navigate these challenges while maintaining profitability will be crucial for its long-term success. Additionally, the demand for minerals like copper and gold is influenced by global economic trends, including technological advancements and infrastructure development, which could affect HudBay's market position.