What's Happening?

USA Rare Earth, a critical minerals startup, experienced a significant increase in its stock value after announcing that the U.S. Department of Commerce will take an equity stake in the company. The Department of Commerce has

issued a letter of intent to provide USA Rare Earth with a $1.3 billion loan and $277 million in federal funding. In return, USA Rare Earth will issue 16.1 million shares of common stock and 17.6 million in warrants to the department. This move could result in the U.S. government holding an 8% to 16% stake in the company, depending on the exercise of the warrants. The company's stock soared over 20% in premarket trading, reflecting investor optimism about the deal.

Why It's Important?

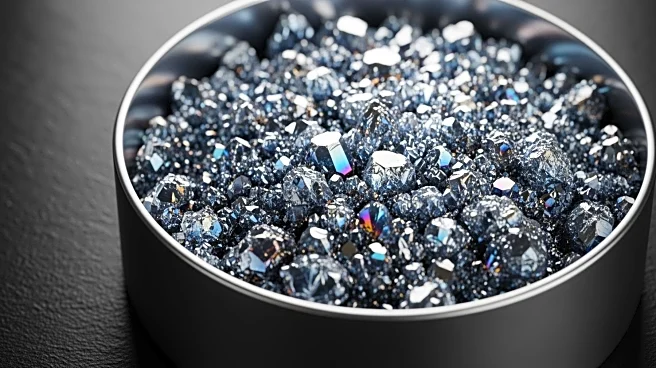

This development is significant as it represents a strategic move by the U.S. government to bolster domestic production of rare earth elements, which are essential for various high-tech industries, including defense, robotics, electric vehicles, and semiconductor manufacturing. By investing in USA Rare Earth, the government aims to reduce the country's reliance on China for these critical minerals. This initiative aligns with broader efforts to secure and grow a resilient and independent rare earth supply chain within the United States. The investment could position USA Rare Earth as a leader in the industry, potentially influencing market dynamics and encouraging further investment in domestic mineral production.

What's Next?

The proposed deal with the Department of Commerce is subject to the finalization of certain conditions. USA Rare Earth plans to raise an additional $1.5 billion from private investors to support its operations and growth. The company's CEO, Barbara Humpton, emphasized the importance of this partnership in establishing a robust rare earth value chain in the U.S. As the deal progresses, it may prompt other companies in the sector to seek similar partnerships with the government, further strengthening the domestic supply chain for critical minerals.