What's Happening?

Taiwan Semiconductor Manufacturing (TSMC), the world's largest chip foundry, is set to announce its fourth-quarter earnings for 2025 on January 15. The company has experienced a significant rise in its share

price, which increased by 54% over the past year. TSMC reported record-high revenue in the third quarter of 2025, with double-digit growth in revenue, net income, and earnings per share (EPS) for the first three quarters. Despite these strong financial results, the company's stock price did not always reflect immediate gains post-earnings announcements, showing fluctuations in the days following each quarterly report.

Why It's Important?

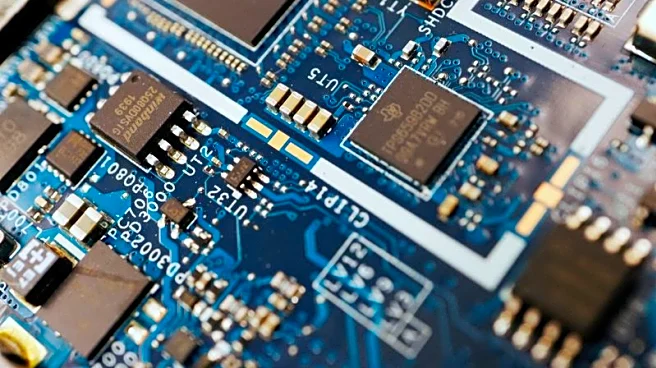

TSMC's performance is crucial as it plays a significant role in the global semiconductor industry, supplying major tech companies like Apple, Broadcom, and Nvidia. The demand for semiconductors has surged, driven by advancements in artificial intelligence and the increasing need for modern electronics. TSMC's growth reflects broader trends in the tech industry, where semiconductors are essential for various applications. Investors are advised to consider TSMC as a long-term investment rather than a short-term earnings play, given its strategic position in the tech supply chain and potential for sustained growth.

What's Next?

As TSMC prepares to release its Q4 2025 earnings, investors and analysts will be closely watching for indications of continued growth and market trends. The company's performance could influence stock market dynamics, particularly in the tech sector. Stakeholders will also be interested in TSMC's future strategies to capitalize on the growing demand for semiconductors and its ability to navigate potential challenges such as supply chain disruptions or market saturation.