What's Happening?

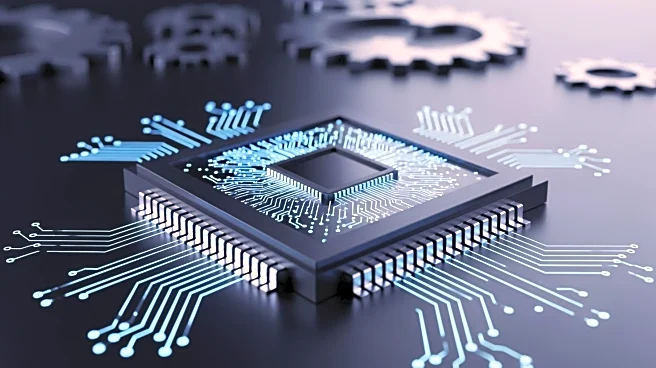

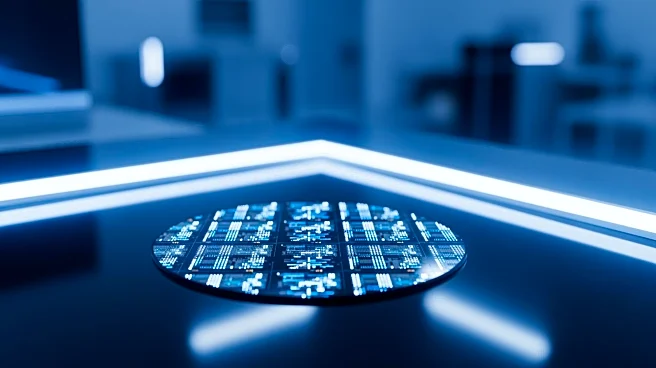

STMicroelectronics, a global semiconductor company, reported its fourth-quarter 2025 earnings, highlighting a return to year-over-year revenue growth despite challenges in the automotive sector. The company achieved a revenue of $3.33 billion, surpassing the midpoint of its outlook range, driven by strong performance in personal electronics, communication equipment, and computer peripherals. However, the automotive segment underperformed due to lower-than-expected inventory pull from tier-one suppliers. The company posted a net loss of $30 million for the quarter, impacted by $141 million in impairment and restructuring costs, and $163 million in non-cash income tax expenses. CEO Jean-Marc Chery emphasized the importance of the partnership with

Sanan in China as a key factor for future competitiveness.

Why It's Important?

The earnings report from STMicroelectronics is significant as it reflects broader trends in the semiconductor industry, particularly the challenges faced by the automotive sector. The company's ability to achieve revenue growth despite these challenges indicates resilience and strategic positioning in other markets such as personal electronics and communication equipment. The partnership with Sanan in China highlights the importance of strategic alliances in maintaining competitiveness in key markets. The financial results also underscore the impact of global supply chain issues and inventory management on the semiconductor industry, which could influence future investment and operational strategies.

What's Next?

Looking ahead, STMicroelectronics plans to invest approximately $2.2 billion in net capital expenditures in 2026, focusing on capacity additions for growth drivers like cloud optical interconnect. The company is also reshaping its manufacturing strategy, reducing capacity in certain areas while expanding in others, such as 8-inch silicon carbide and 300mm silicon. Management expects improvements in gross margins as unused capacity charges decline and seasonal revenue increases in the second half of 2026. The acquisition of NXP's MEMS sensor business, expected to close in the first half of 2026, is anticipated to bolster the company's growth in MEMS and imaging sensors.