What's Happening?

The Digital Asset Market CLARITY Act of 2025, a legislative effort to establish clear regulatory guidelines for digital assets in the U.S., has encountered significant delays in the Senate. Initially passed by the House of Representatives in July 2025, the bill aimed to end 'regulation by enforcement' by categorizing digital assets and delineating oversight between the SEC and CFTC. However, the Senate has introduced controversial amendments, such as stablecoin yield bans and expanded DeFi oversight, leading to a withdrawal of support from major industry players like Coinbase. These amendments have caused a breakdown in consensus, stalling the bill's progress.

Why It's Important?

The stalling of the CLARITY Act in the Senate has significant implications for the U.S.

crypto industry. The bill was designed to provide a clear regulatory framework, which is crucial for fostering innovation and maintaining the U.S. as a hub for crypto activities. The amendments introduced in the Senate, perceived as anti-competitive, could hinder the growth of the crypto sector by imposing restrictive measures on stablecoins and DeFi. This legislative uncertainty may drive crypto businesses offshore, impacting the U.S. economy and its position in the global digital asset market.

What's Next?

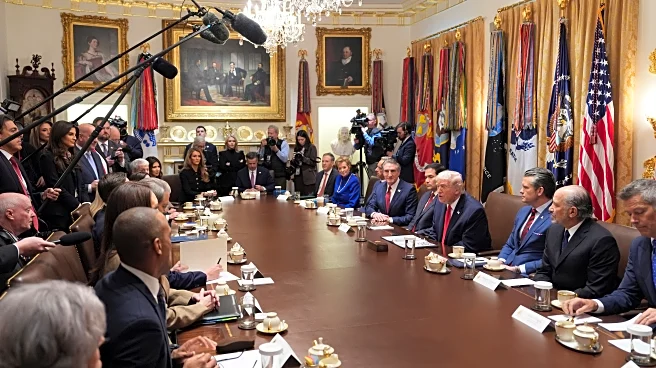

Negotiations are ongoing between the White House, banking lobbyists, and crypto firms to resolve the impasse. The Senate markup has been postponed, and the outcome of these discussions will determine the future of the CLARITY Act. Meanwhile, the recently passed GENIUS Act, which regulates stablecoins separately, highlights the urgency for a comprehensive market structure bill. Stakeholders are closely monitoring the situation, as the final version of the CLARITY Act will shape the regulatory landscape for digital assets in the U.S.