What's Happening?

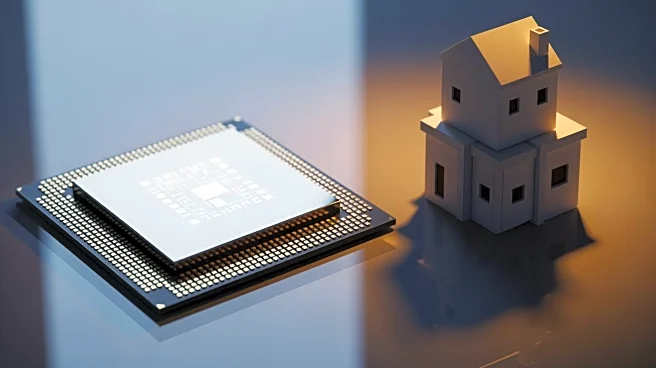

Recent economic indicators reveal a rise in chip prices alongside a decline in apartment rental costs. The chip market is experiencing a significant memory problem, affecting prices and availability. Meanwhile,

rental prices are showing a surprising decrease, which could impact housing affordability and consumer spending. Additionally, there is a mystery surrounding holiday spending, with questions about whether consumers are cutting back on gifts this season.

Why It's Important?

The fluctuation in chip prices and rental costs reflects broader economic trends that could affect various stakeholders. Rising chip prices may impact technology manufacturers and consumers, potentially leading to higher costs for electronic devices. The decline in rental prices could benefit renters but may signal underlying issues in the housing market. These economic shifts are crucial for policymakers and businesses as they navigate the complexities of consumer behavior and market dynamics during the holiday season.