What's Happening?

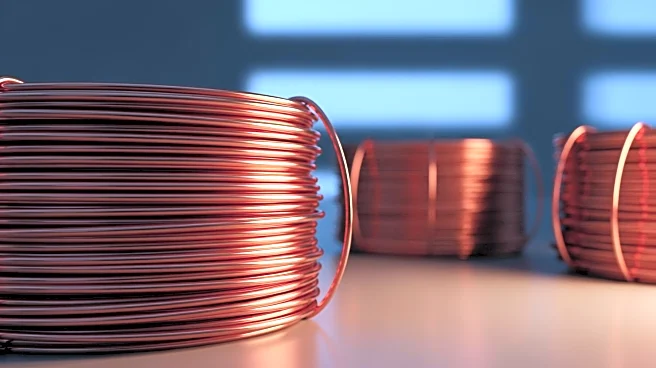

Bajaj Electricals Limited, a prominent Indian consumer electricals company, has announced its entry into the wire manufacturing business under its Lighting Solutions segment. This strategic move aims to capitalize on the growing demand in the industry. Following the announcement, the company's stock surged by up to 11% during the trading session. Bajaj Electricals plans to launch new products in this segment soon and will assess further investments based on market response and operational needs. The company has committed to keeping stock exchanges informed of any significant developments. The Lighting Solutions segment currently enjoys margins of around 10%, aligning with industry peers in the cables and wires space. The wires segment is noted

for being less competitive than cables, offering better export margin potential. Bajaj Electricals' lighting business reported a strong performance in the second quarter, with a 9.6% revenue growth and an EBIT margin of 7.9%, driven by price stabilization in LEDs and robust consumer demand.

Why It's Important?

The entry of Bajaj Electricals into the wire manufacturing sector is significant as it represents a strategic diversification aimed at tapping into a less competitive market with promising export potential. This move could enhance the company's revenue streams and improve its market position in the electrical equipment industry. The positive stock market reaction reflects investor confidence in the company's growth strategy. However, the company faces challenges, including cost pressures and limited operating leverage, as indicated by its recent financial performance. The expansion into wire manufacturing could help mitigate these challenges by providing a new revenue source and potentially improving profit margins. This development is crucial for stakeholders, including investors and industry competitors, as it may influence market dynamics and competitive strategies within the electrical equipment sector.

What's Next?

Bajaj Electricals is expected to proceed with the launch of its wire products and evaluate market responses to determine further investment strategies. The company will likely focus on optimizing its operations to enhance profitability and address cost pressures. Stakeholders, including investors and industry analysts, will be closely monitoring the company's performance in this new segment and its impact on overall financial health. The company's ability to successfully integrate this new business line and achieve the anticipated margins will be critical in maintaining investor confidence and achieving long-term growth objectives.