What's Happening?

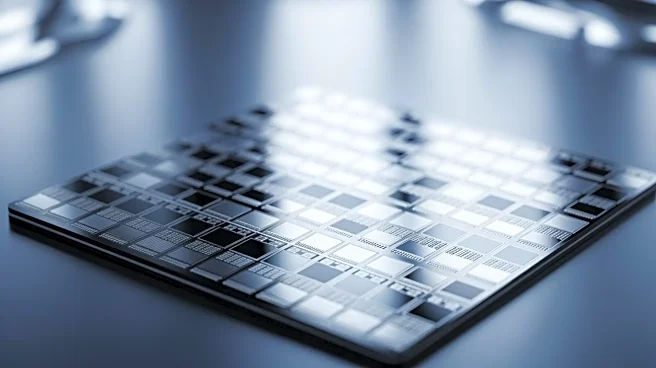

Taiwan Semiconductor Manufacturing Company (TSMC) reported a significant earnings beat, with its revenue forecast for 2026 exceeding expectations. The company anticipates a 30% year-over-year revenue increase, driven by strong demand for artificial intelligence (AI) applications. This positive performance is seen as a favorable indicator for other tech stocks, including Nvidia and Broadcom, which are part of the same sector. The demand for smartphones and PCs remains robust, further supporting TSMC's optimistic outlook. The news has positively impacted the stock market, with major indices rising as investors react to the earnings report.

Why It's Important?

TSMC's earnings report is crucial as it signals strong growth in the tech sector, particularly in AI and semiconductor

industries. This growth is likely to benefit companies like Nvidia and Broadcom, which are heavily invested in these technologies. The positive market reaction underscores investor confidence in the tech industry's resilience and potential for continued expansion. The strong demand for AI and related technologies suggests a sustained trend that could drive innovation and economic growth. This development is particularly significant for the U.S. tech market, which relies on semiconductor advancements to maintain its competitive edge globally.

What's Next?

Following TSMC's earnings announcement, investors and analysts will closely monitor the performance of related tech stocks to gauge the broader market impact. Companies like Nvidia and Broadcom may see increased investor interest, potentially leading to stock price adjustments. Additionally, the sustained demand for AI and semiconductor products could prompt further investments in research and development, driving innovation in the tech sector. Market participants will also watch for any geopolitical developments that could affect the semiconductor supply chain, as these could influence future earnings and market dynamics.