What's Happening?

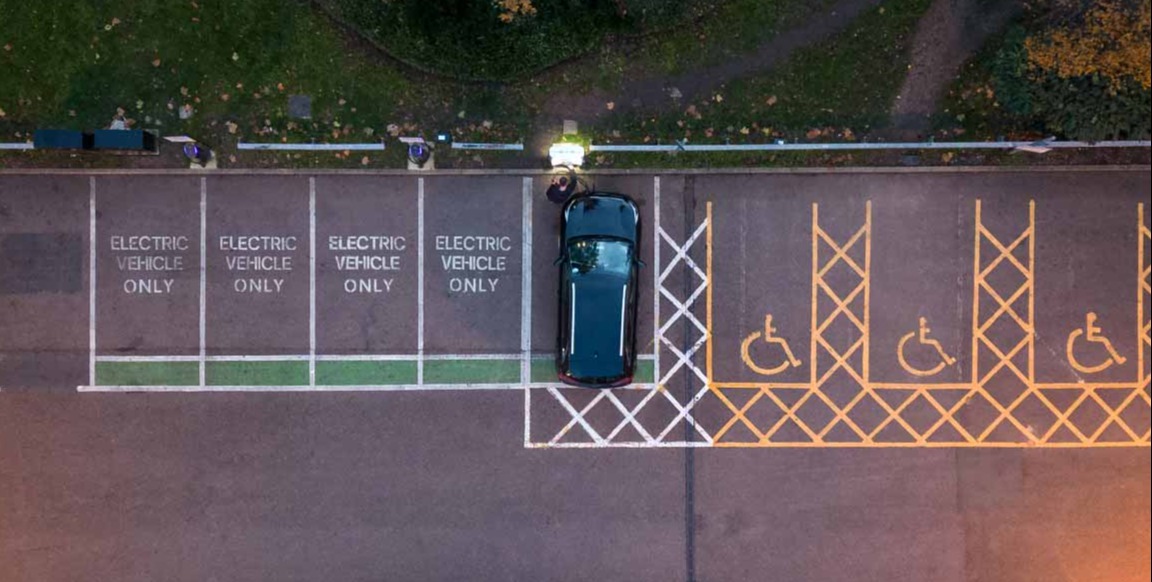

Tesla's stock closed at $481.20, down 0.45%, after a volatile trading session on December 19, 2025. The stock's movement was influenced by several factors, including a Delaware Supreme Court decision reinstating Elon Musk's 2018 pay package, which had been previously rescinded. This package allows Musk to earn options tied to performance milestones, significantly impacting Tesla's stock value. Additionally, the California DMV has mandated changes to Tesla's marketing of its 'Autopilot' and 'Full Self-Driving Capability' features, threatening a 30-day suspension of Tesla's dealer license if not addressed within 60 days. These developments, along with a tech-led market rally and major options expiration, contributed to the stock's fluctuations.

Why It's Important?

The reinstatement of Musk's pay package removes a significant governance issue for Tesla, potentially stabilizing investor sentiment. However, the California DMV's decision poses a regulatory challenge that could affect Tesla's operations in a key market. The company's stock is closely tied to Musk's leadership and the perception of its technological advancements, making these developments critical for investors. The regulatory scrutiny over Tesla's marketing practices highlights the ongoing debate about the company's valuation and its positioning as a tech leader rather than a traditional automaker.

What's Next?

Investors will be closely monitoring Tesla's response to the California DMV's demands and any further clarifications regarding Musk's compensation. The company's ability to navigate these challenges without significant disruption will be crucial. Additionally, the market will be watching for any shifts in investor sentiment as Tesla continues to operate near record stock price levels. The outcome of these regulatory and governance issues could influence Tesla's strategic direction and its standing in the competitive EV market.