What's Happening?

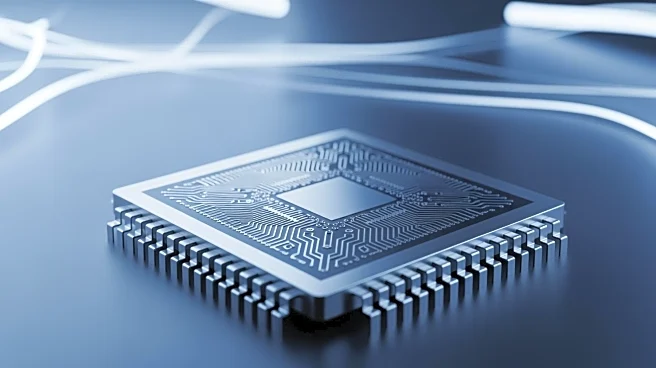

Wedbush Securities Inc. has increased its holdings in Taiwan Semiconductor Manufacturing Company Ltd. (TSMC) by 10% during the third quarter, as per its latest SEC filing. The firm now owns 19,897 shares valued at $5,557,000. This move is part of a broader trend among institutional investors, with several hedge funds also modifying their positions in TSMC. Elmwood Wealth Management Inc. increased its holdings by 91%, while Westover Capital Advisors LLC grew its stake by 4.2%. Analysts have responded positively, with Barclays and Needham & Company LLC raising their price targets for TSMC, reflecting strong market confidence in the company's future performance.

Why It's Important?

The increased investment by Wedbush Securities and other institutional investors signals

strong confidence in TSMC's market position and future growth prospects. TSMC is a leading player in the semiconductor industry, which is crucial for various sectors including technology, automotive, and consumer electronics. The company's ability to attract significant institutional investment suggests a positive outlook for its stock performance, potentially influencing market trends and investor strategies. This development is particularly relevant as the semiconductor industry continues to recover from supply chain disruptions and increased demand for advanced technologies.

What's Next?

With the semiconductor industry poised for growth, TSMC's strategic positioning and investor confidence could lead to further stock appreciation. Analysts have set new price targets, indicating expectations of continued strong performance. The company's focus on expanding its manufacturing capabilities and diversifying its production locations may further enhance its market position. Investors and stakeholders will likely monitor TSMC's quarterly earnings and strategic initiatives closely, as these will provide insights into the company's ability to capitalize on industry trends and maintain its competitive edge.