What's Happening?

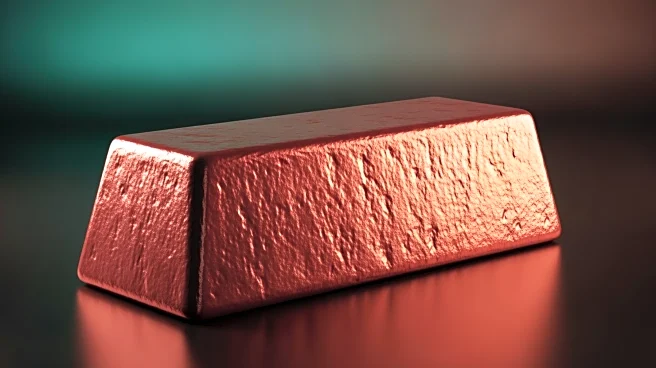

JX Advanced Metals has announced an increase in its net profit and dividend forecasts for the fiscal year ending in March, driven by strong demand for materials used in artificial intelligence server applications and higher copper prices. The Japanese company has raised its annual net profit guidance to 93 billion yen, up from a previous estimate of 79 billion yen. The demand for key products in the information and communications materials segment is expanding faster than anticipated, contributing to the company's robust performance. Additionally, JX Advanced Metals has increased its annual dividend forecast from 21 yen per share to 27 yen per share. The company is also engaged in negotiations over treatment and refining charges with global

miners, securing agreements at levels slightly above those agreed upon by Chinese smelters.

Why It's Important?

The increase in profit and dividend forecasts by JX Advanced Metals highlights the growing demand for materials essential in the development of artificial intelligence technologies. This trend underscores the broader economic impact of AI on various industries, particularly in the tech sector, where the need for advanced materials is accelerating. The rise in copper prices also reflects global economic conditions and the demand for raw materials in technology and infrastructure projects. For investors and stakeholders, the company's improved financial outlook signals potential growth opportunities and increased shareholder value. The ongoing negotiations over treatment and refining charges indicate a competitive landscape in the global metals market, with implications for pricing and supply chain dynamics.