What's Happening?

The U.S. stock market began the holiday-shortened week with gains, driven by renewed interest in the artificial intelligence sector, boosting major tech companies. The S&P 500 erased its December losses,

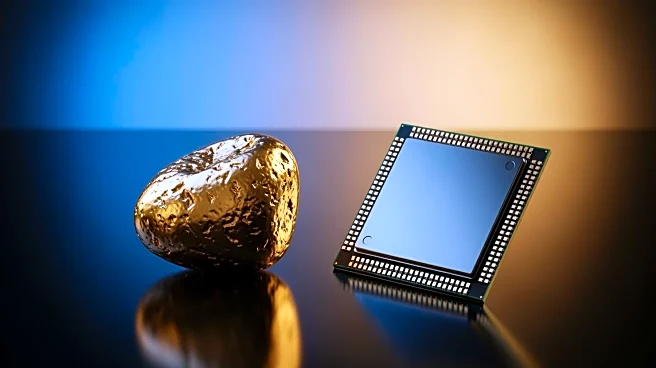

marking an eighth consecutive month of gains, the longest streak since 2018. Nvidia Corp. saw a rise following reports of plans to ship advanced AI chips to China. Despite volatility and concerns over AI valuations, tech stocks have led market gains this year. Meanwhile, gold and silver prices reached all-time highs amid geopolitical tensions, and oil prices rose as the dollar weakened. The Federal Reserve's future policy path remains a focal point, with expectations of rate cuts next year.

Why It's Important?

The rally in tech stocks underscores the sector's pivotal role in driving market performance, highlighting investor confidence in AI and technology's growth potential. This trend could influence investment strategies and market dynamics in 2026. The record highs in gold and silver prices reflect investor caution and a shift towards safe-haven assets amid geopolitical uncertainties. These developments could impact commodity markets and influence monetary policy decisions. The Federal Reserve's actions will be closely watched, as interest rate changes can significantly affect economic growth, borrowing costs, and market sentiment.

What's Next?

As the year ends, investors will be keenly observing the Federal Reserve's policy signals and upcoming economic data releases. The tech sector's performance will be crucial in determining market trends, with potential corrections anticipated. The geopolitical landscape and its impact on commodity prices will also be a key focus. Stakeholders will need to navigate these uncertainties, balancing risk and opportunity in their investment strategies. The market's response to these factors will shape the economic outlook for 2026, influencing both domestic and global financial markets.