What's Happening?

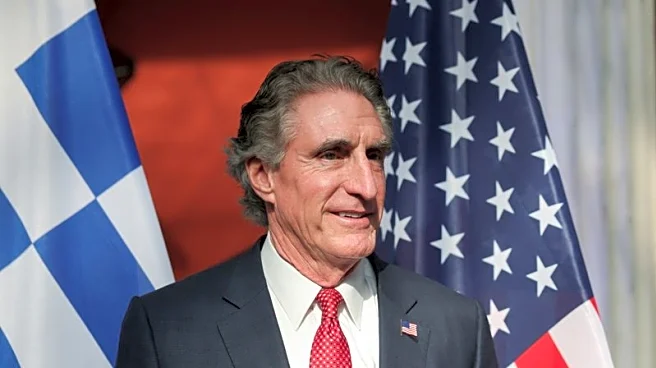

Nova Minerals has announced plans to redomicile to the United States following the loss of its foreign private issuer status, effective from July 2026. This decision comes as a majority of Nova's shares are now held by U.S. investors. The company will maintain its dual listing on the ASX and NASDAQ, with ASX shareholders receiving CHESS Depositary Interests and NASDAQ ADS holders receiving common stock in the new U.S.-based entity. The redomiciliation is expected to be completed by June 2026, pending shareholder and regulatory approvals. CEO Christopher Gerteisen highlighted the strategic benefits of this move, which will allow larger institutional investors to participate in the company. Additionally, Nova plans to acquire the remaining 15%

interest in the Estelle Gold and Critical Minerals Project, enhancing its control over the project.

Why It's Important?

Nova Minerals' decision to redomicile in the U.S. underscores the growing influence of American investors in the company and highlights the strategic importance of aligning with U.S. financial markets. This move is likely to enhance Nova's access to capital and broaden its investor base, potentially leading to increased liquidity and valuation. The acquisition of full ownership of the Estelle Gold and Critical Minerals Project positions Nova to advance its development and production capabilities, which could significantly impact its growth trajectory. The redomiciliation also reflects broader trends of globalization in the mining industry, where companies seek to optimize their corporate structures to align with investor interests and regulatory environments.