What's Happening?

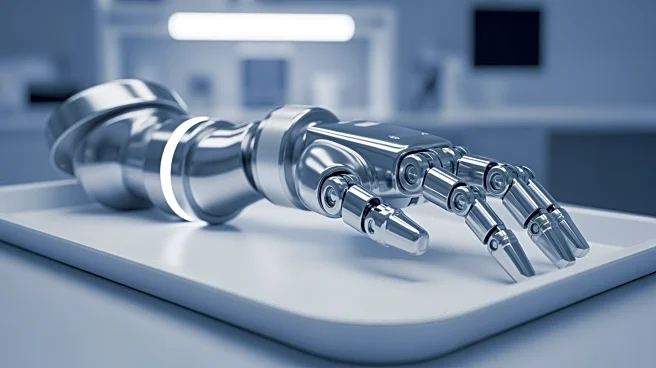

Medtronic plc (NYSE: MDT) has received FDA clearance for its Hugo robotic-assisted surgery system, marking a significant milestone for the company's expansion into the U.S. market. This clearance allows

Hugo to be used for minimally invasive urologic procedures, a market with approximately 230,000 surgeries annually. Concurrently, Medtronic is advancing its strategic plan to spin off its Diabetes business into a separate entity, aiming to complete the separation by late 2026. The company also announced a quarterly dividend of $0.71 per share, continuing its 48-year streak of dividend increases. These developments come as Medtronic's stock trades around $101.4, with a market cap of approximately $130 billion.

Why It's Important?

The FDA clearance for the Hugo system positions Medtronic to compete in the growing robotic surgery market, which is currently dominated by Intuitive Surgical. This move is part of Medtronic's broader strategy to enhance its growth profile and focus on high-margin businesses. The planned spin-off of the Diabetes unit is expected to unlock value by allowing Medtronic to concentrate on its core areas, potentially improving its overall margin profile. The company's strong dividend track record and recent stock performance, up over 30% year-to-date, reflect investor confidence in its strategic direction. However, challenges such as tariff headwinds and execution risks related to the spin-off remain.

What's Next?

Medtronic plans a strategic rollout of the Hugo system in the U.S., with future indications for general and gynecologic surgery, which could significantly expand its market reach. The company will continue to focus on its core cardiovascular, neuroscience, and surgical businesses post-spin-off. Analysts will be watching for further developments in Medtronic's product pipeline and the execution of the Diabetes spin-off. The company's ability to navigate competitive pressures and regulatory challenges will be crucial for sustaining its growth momentum.