What's Happening?

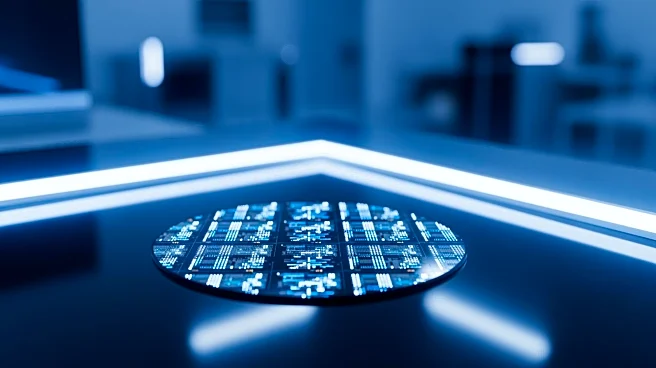

The ocean freight industry is navigating a complex landscape in 2026, characterized by weak demand, excess capacity, and policy risks. The White House's tariff actions have significantly impacted the sector, leading to fluctuations in import volumes as shippers rushed to bring goods into the U.S. before potential cost increases. Despite expectations, these tariffs have not yet led to significant inflation in consumer prices, although consumer sentiment remains low. The freight rates are under pressure due to declining U.S. imports of consumer goods and an increase in vessel capacity. This situation is compounded by the redirection of exports from China to other regions, as U.S. demand remains weaker than anticipated.

Why It's Important?

The current state of the

ocean freight industry has significant implications for U.S. importers and the broader economy. The ongoing tariff situation adds uncertainty, potentially affecting pricing and supply chain strategies. The weak demand and excess capacity could lead to lower freight rates, impacting the profitability of carriers. Additionally, the shift in global trade patterns, with China expanding its export focus beyond the U.S., may alter the dynamics of international trade. These developments could influence consumer prices and economic growth, particularly if tariffs begin to affect costs more directly.

What's Next?

Looking ahead, the industry faces several challenges, including the potential for further tariff-related disruptions and the impact of new vessel capacity entering the market. The reopening of Red Sea transits could exacerbate overcapacity issues, further driving down freight rates. Shippers may need to reconsider their long-term contract strategies in light of these uncertainties. The evolution of carrier alliances and the shift towards a 'China plus 10' trade model could also reshape the industry landscape, requiring stakeholders to adapt to new trade routes and market conditions.