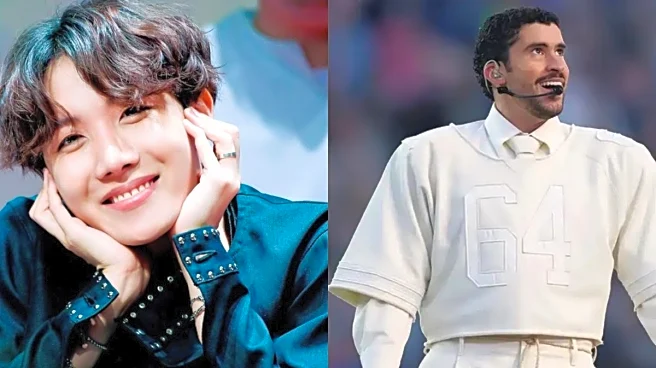

Cha

Eun-Woo's alleged tax-evasion case has transcended into legal complaints now. The ASTRO member-turned-actor, who is currently under investigation by the National Tax Service for a scandal worth 20 billion KRW (about $13.7 million), is undergoing a muddy tax laundering that seems to be getting deeper. Reports first surfaced on January 22 that Cha is accused of evading taxes for running a "one-person company" which apparently turned out to be in the name of his mother. In the latest update, a civic group has decided to file a police complaint with the National Police Agency's investigation unit against individuals involved in leaking private tax information about Cha.

Details about complaint

On February 10, Korean media reported that the citizen group Taxpayers' Union has lodged a complaint against the reporter who reported the 20 billion KRW case. The complaint also names an unidentified tax official accused of disclosing confidential tax audit info without authorisation. The charges cited include alleged violations of the Personal Information Protection Act and leaking official secrets under the Criminal Act.

Reason behind the complaint

The civic group argued that leaking confidential tax data is illegal and harms taxpayer privacy and rights. Media reporting on Cha Eun-Woo's tax situation likely wouldn't be possible without the leak by a tax official. Authorities thus hold a responsibility to investigate and punish any internal leaks to protect the integrity of tax processes and uphold the presumption of innocence.

Cha Eun-Woo's tax evasion scandal

On January 22, OSEN reported that Cha had been notified by the National Tax Service of a tax reassessment. While his agency Fantagio initially rejected the allegation, Cha later apologised and said he would accept the authorities' final decision and live more carefully going forward.Suspicion arose after Cha's "

one-person agency" came under scanner which officials claimed was aimed at reducing income taxes. Cha had allegedly established a corporation in the name of his mother, which was inserted between Fantagio and the star. The contract was meant to provide support services for his entertainment activities, and his earnings were divided between Fantagio, the corporation, and himself.Cha's case is touted to be one of the largest additional tax assessments, including income tax ever imposed on a Korean celebrity. Infact it followed a pattern similar to recent tax evasion cases involving celebrities such as Sung Si-Kyung and Ok Joo-Hyun.

Taxpayers' Union statement

"We have filed a complaint with the National Police Agency’s National Investigation Headquarters against an unidentified tax official who leaked Cha Eun-woo’s tax investigation information and the reporter who first reported it, on charges of violating the Personal Information Protection Act and criminal secrecy breaches.The accused unauthorisedly leaked specific tax information related to Cha Eun-woo’s tax investigation, violating the secrecy principle guaranteed by the Framework Act on National Taxes and infringing on taxpayer rights. Such information leaks are serious matters that can cause irreparable harm to the individuals involved. This is not to defend or support any individual but to establish social trust that ‘tax information is always securely protected.’ Incidents like the past Lee Sun Kyun case, where unverified investigations and information were disclosed, causing irreparable damage to personal honor and human rights, must not be repeated."Attorney Lee Kyung-Hwan, representing the complainants, stated, "Cha Eunwoo, as a Korean citizen and taxpayer, should be equally protected by taxpayer rights under the Framework Act on National Taxes and the constitutional presumption of innocence. The law must be enforced equally regardless of fame, and it is undesirable that tax information is leaked and social stigma attached merely because one is famous."

/images/ppid_a911dc6a-image-17707096427193331.webp)

/images/ppid_59c68470-image-177065505265365483.webp)

/images/ppid_a911dc6a-image-177087757876223393.webp)

/images/ppid_59c68470-image-17706575780372121.webp)

/images/ppid_a911dc6a-image-17706465384079403.webp)