What is the story about?

FDI in Public Sector Banks: The government is reportedly considering allowing foreign investors to own up to 49 per cent in state-run banks. This move

is being considered to help these banks raise more capital for growth, while the government still keeps overall control, a top official said.

FDI in PSBs: What's Current Limit?

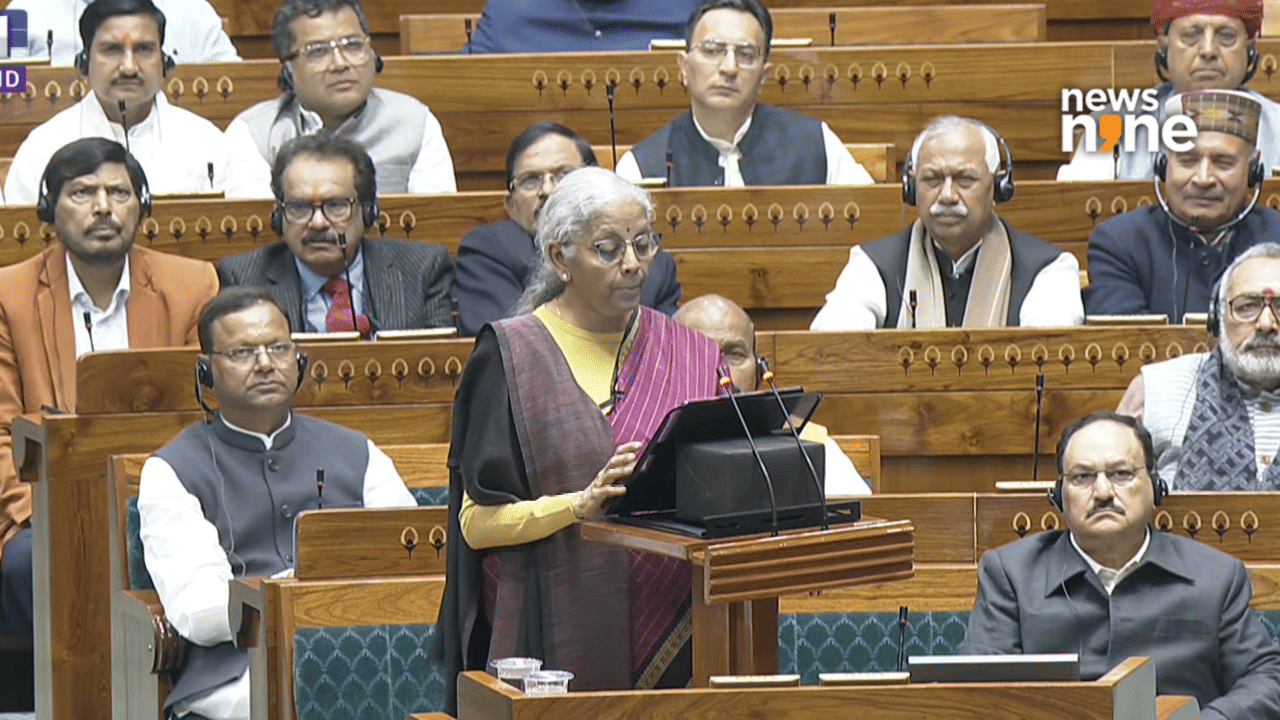

According to a report by Bloomberg, the government is discussing raising the foreign direct investment cap to 49 per cent from 20 per cent, financial services secretary M. Nagaraju told reporters on Monday.He was speaking to reporters in New Delhi a day after Finance Minister Nirmala Sitharaman presented budget 2026.

Foreign ownership in State Bank of India - the country’s largest lender - and 11 other state-owned banks is capped at 20 per cent, a legacy restriction rooted in the government’s desire to retain strategic control of the financial system.

Foreign interest in India's banking industry is on the rise as evidenced for instance by Dubai-based Emirates NBD's $3 billion purchase of a 60% stake in private RBL Bank, Reuters said in a report.

"Government discussing raising FDI limit in state-run banks," says DFS Secretary M. Nagaraju (Agencies)@DFS_India #PSUBanks #StockMarketIndia #IDBI pic.twitter.com/QTvynKFCbM

— ET NOW (@ETNOWlive) February 2, 2026

FDI in Private Sector Banks

The limit is far lower than the 74 per cent foreign investment allowed in private-sector banks and 100 per cent foreign direct investment in local insurance companies, the report said.The ceiling applies to all overseas holdings combined, including foreign institutional investors, pension funds and other non-resident shareholders.

While portfolio investors can buy SBI shares freely within the cap, any breach would require regulatory intervention, effectively constraining demand from global funds even as India’s equities gain weight in international benchmarks.

India has 12 government-owned banks with combined assets of Rs. 1.71 lakh crore ($1.95 trillion) as of March 2025, accounting for 55 per cent of the banking sector.

Public Sector Banks in India list

- Bank of Baroda

- Bank of India

- Bank of Maharashtra

- Canara Bank

- Central Bank of India

- Indian Bank

- Indian Overseas Bank

- Punjab National Bank

- Punjab & Sind Bank

- State Bank of India

- Union Bank of India

- UCO Bank

Government may also launch an offer next year to sell a portion of its stake in the insurance behemoth Life Insurance Corporation, he added.

The government will also get financial bids for IDBI Bank this month, Nagaraju said.

The government, which owns 45.48 per cent in IDBI Bank, and state-owned LIC which holds 49.24 per cent, together plan to sell 60.7 per cent of the lender. IDBI Bank had to be rescued by the state-owned insurer in 2019 after a surge in bad loans at the lender.

(With agency inputs)