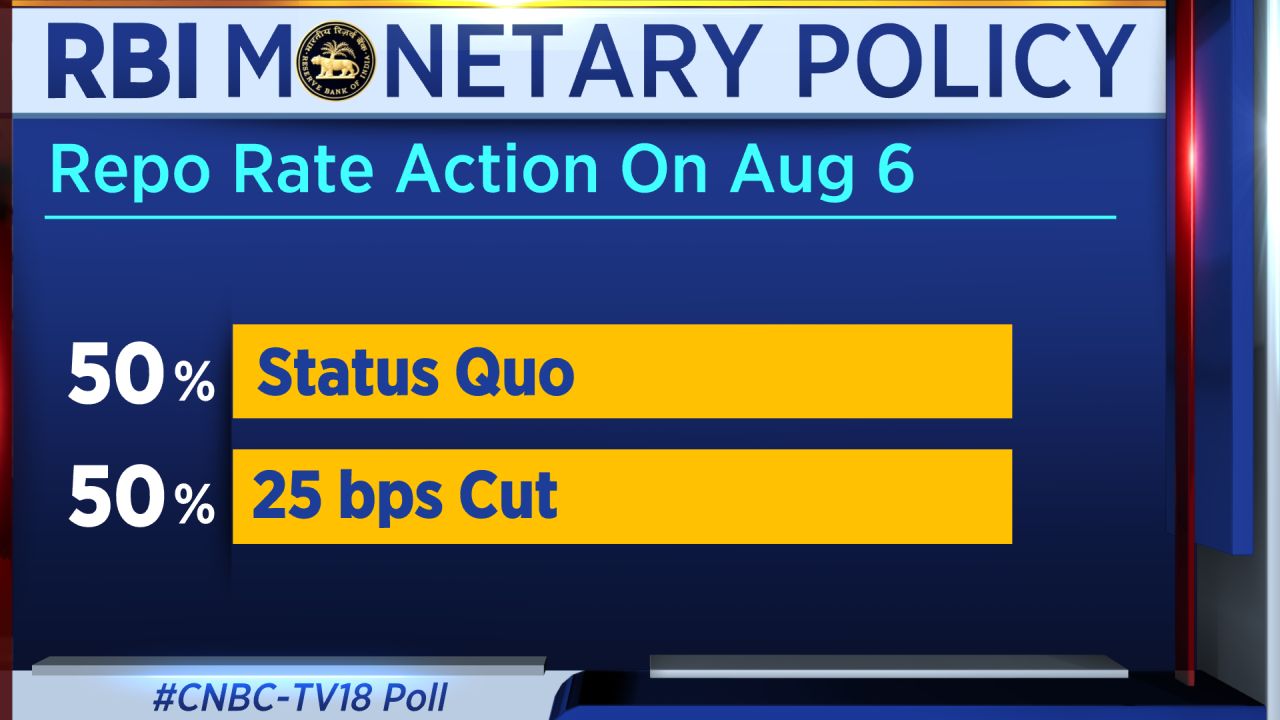

A CNBC-TV18 poll of top economists shows a clear divide: half expect a 25 basis point rate cut, while the other half believe the Monetary Policy Committee (MPC) will keep rates unchanged.

Looking at the broader economic picture, inflation has dropped to a 77-month low. The Consumer Price Index (CPI) is expected to average below 3% for the year. Some economists, including those from SBI, warn that delaying a rate cut now could be a costly "type two error" — waiting too long and hurting growth even though inflation is already under control.

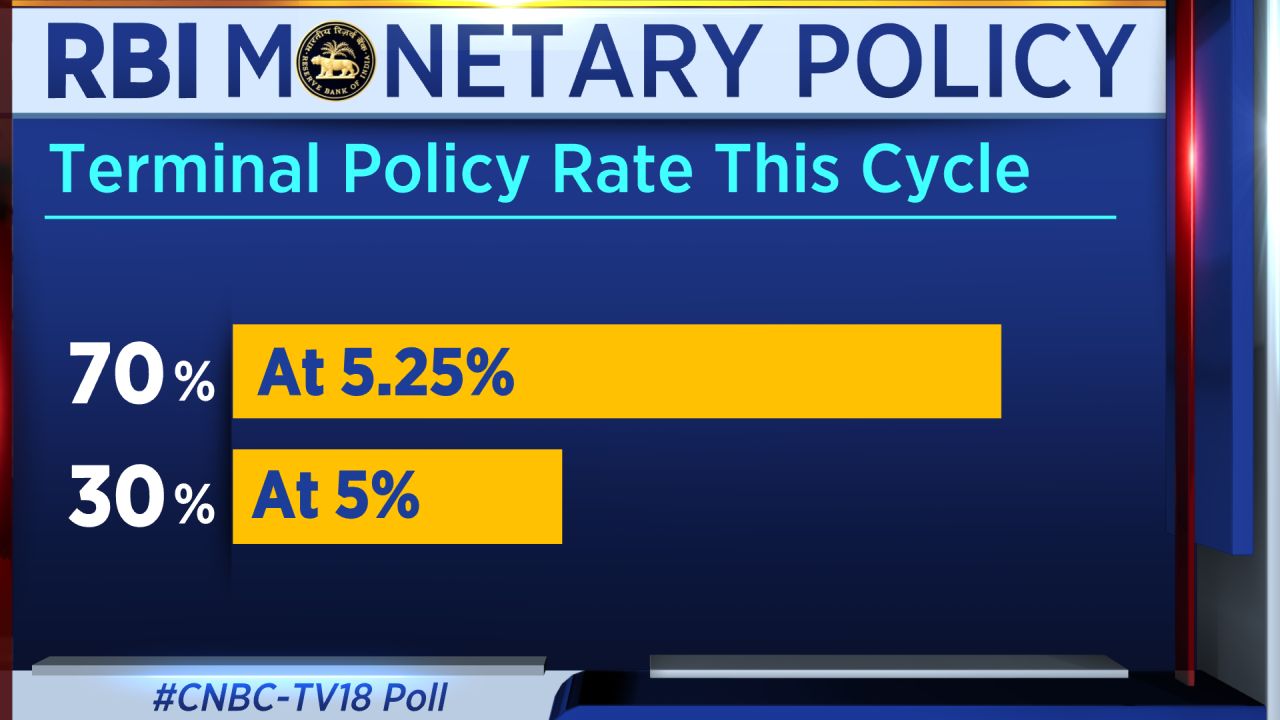

Most economists believe the terminal policy rate will settle at 5.25%. That means just one more 25 basis point cut would complete the current easing cycle.

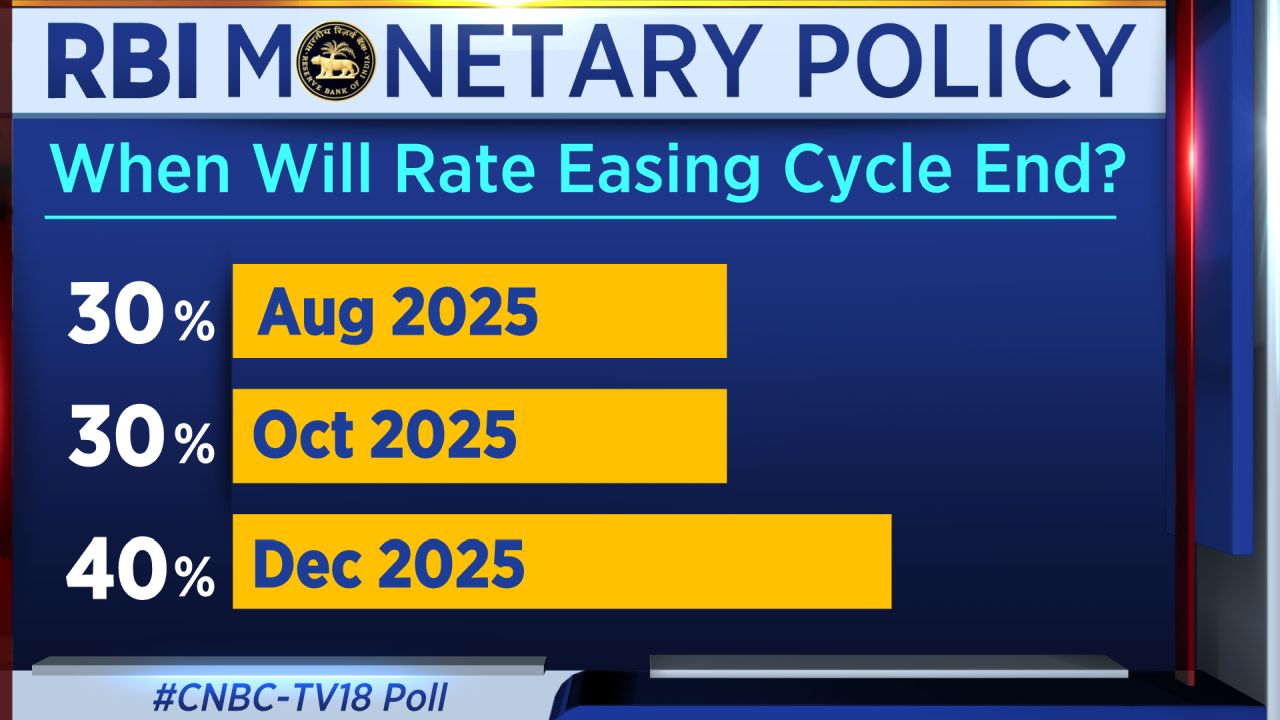

However, there is no consensus on when that final cut will happen. The poll shows 30% expecting it in August, another 30% in October, while December is still the most common prediction — suggesting the cycle is nearing its end.

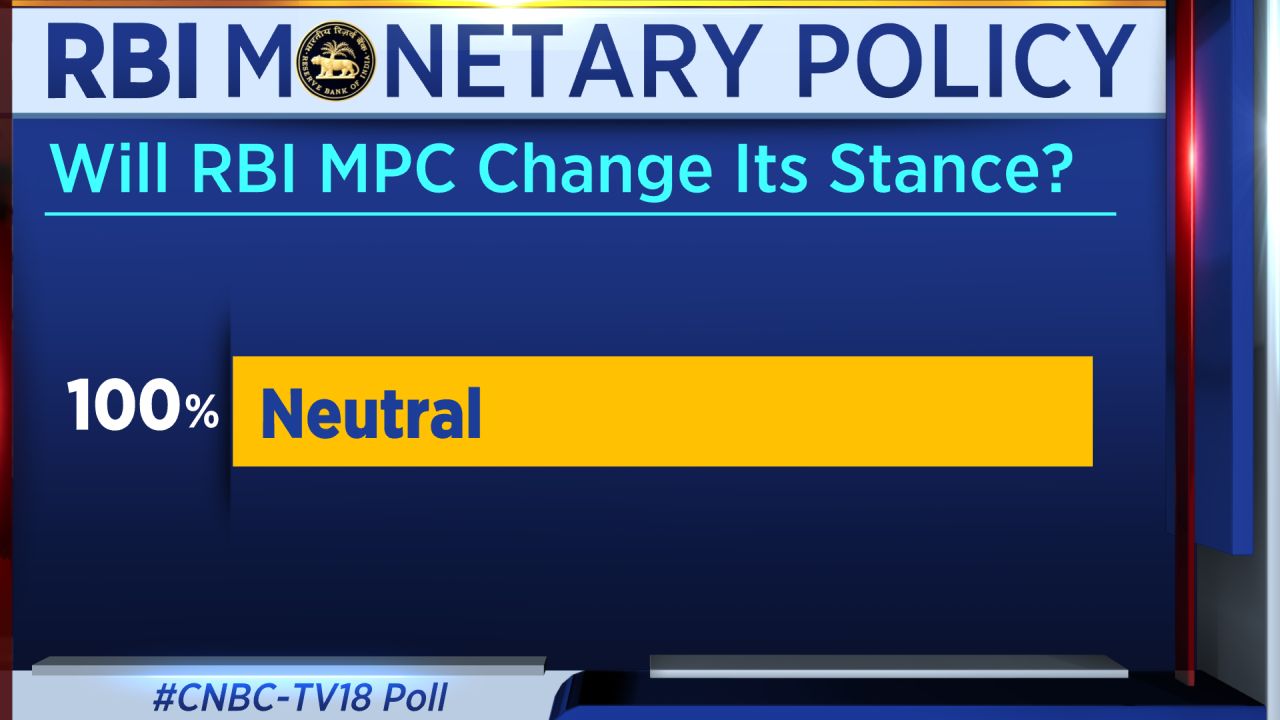

On policy stance, there is agreement: all economists expect the RBI to maintain a neutral stance. But the tone may turn dovish, as inflation is easing and growth signals are becoming mixed.

Regarding growth, 70% of respondents believe the RBI will keep its forecast unchanged. However, it may highlight signs of slowing momentum.

On inflation, 90% expect the RBI to revise its forecast downward — possibly to around 3.0–3.3% due to falling food prices and a favourable base effect.

As for the policy tone, 60% expect it to stay neutral, while 40% lean towards a dovish tone. This aligns with improved credit transmission and continued liquidity surplus in the system.

The wild card remains tariffs and global trade tensions. Half of the economists say these will not influence policy directly. But 40% believe external risks could push the RBI to ease further. For now, most agree it’s a wait-and-watch situation.

Finally, economists are also watching for updates on the liquidity management framework, comments on the growth outlook, and a possible extension of external benchmark-linked lending rates to NBFCs.

Also Read | RBI monetary policy: Is a rate cut coming on August 6? Economists weigh in