What is the story about?

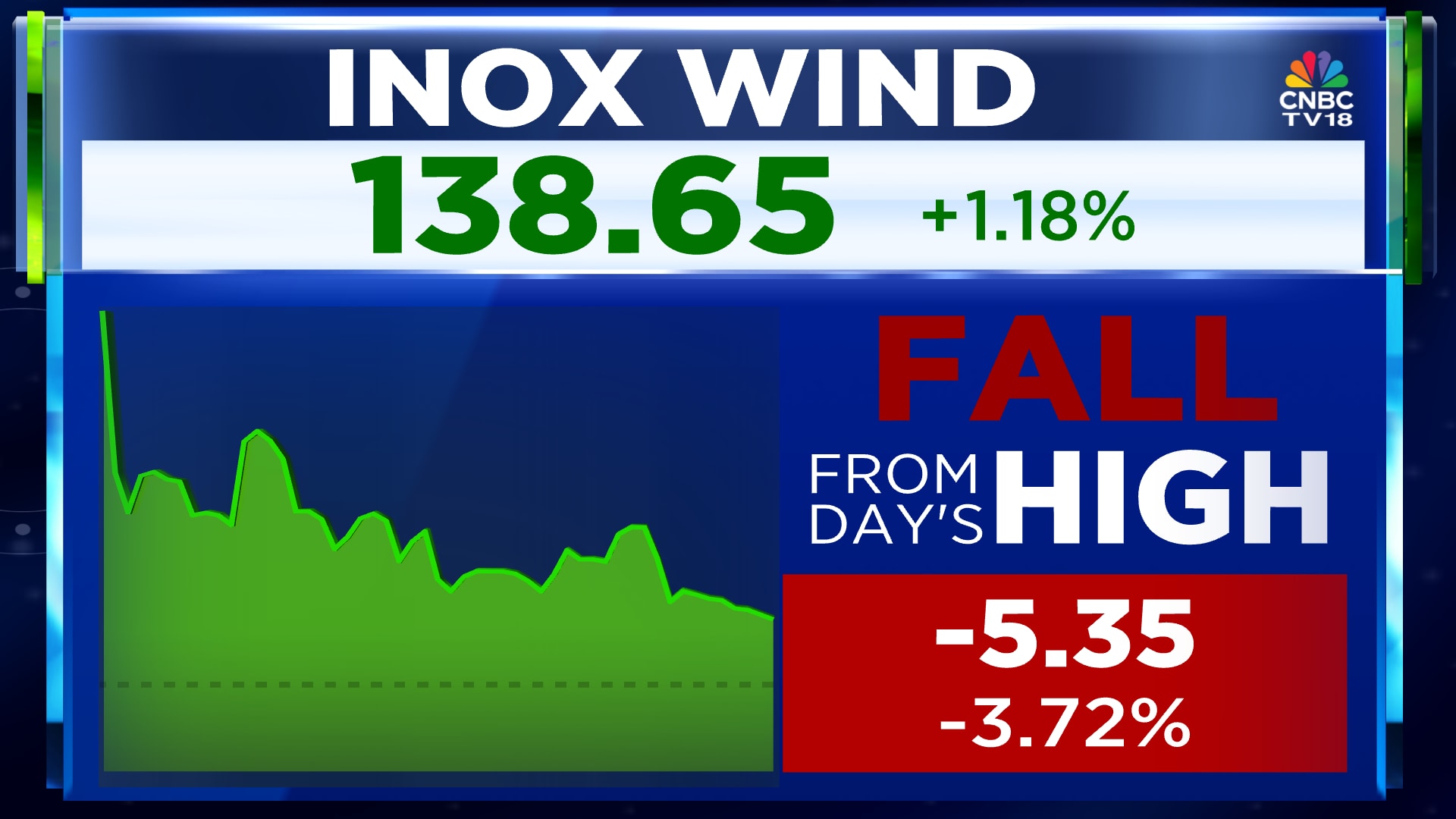

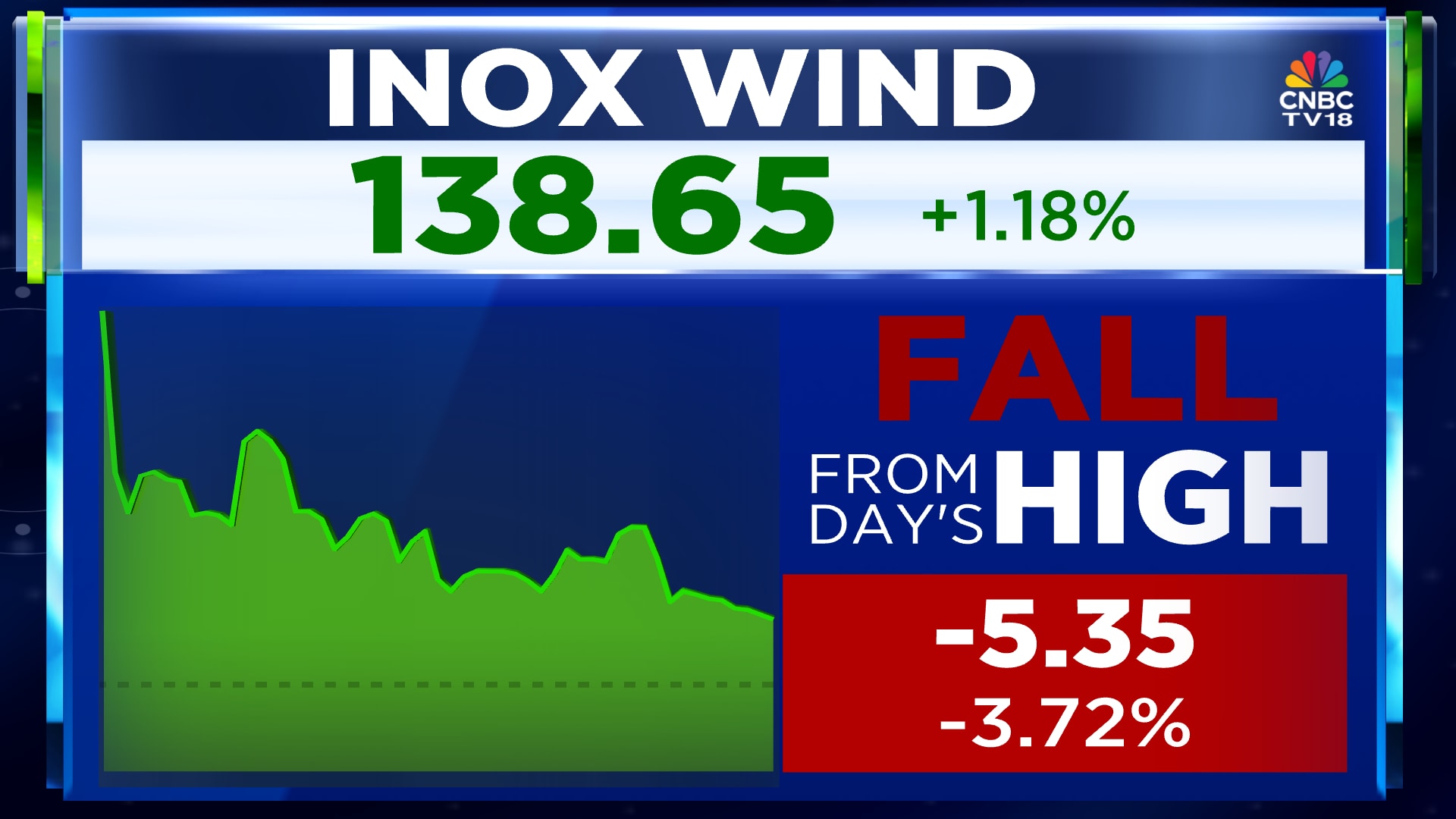

Shares of Inox Wind Ltd. are off their opening highs on Monday, August 18, after brokerage firm Nuvama cut its price target on the stock by 19%. The stock was up as much as 6% in early trading.

However, Nuvama has maintained its "buy" recommendation on the stock, but the price target was cut to ₹190 from ₹236. Despite the cut, Nuvama's revised target implies a potential upside of 39% for Inox Wind from current levels.

Nuvama said Inox Wind reported modest execution in the June quarter at 146 mega watt (MW) in comparison to the consensus estimate of 180 MW.

It said the company's muted revenue of ₹830 crore during the June quarter, was offset by higher operating profit margin at 22.2%.

Order intake was soft at 51 MW, taking the order book to 3.1 GW, with an execution period of over 24 months, Nuvama said. The brokerage has cut its financial year 2026 and 2027 execution timelines to 1.1 GW and 1.8 GW from 1.2 GW and 2 GW respectively.

Inox Wind's consolidated profit after tax increased to ₹105.8 crore in the June quarter from ₹10.3 crore in the previous year. Profitability was aided by higher other income, which increased to ₹36.3 crore from ₹15.1 crore last year. Finance costs decreased to ₹33.8 crore in the June quarter from ₹55.8 crore.

Its revenue for the first quarter increased 29.2% to ₹826.3 crore from ₹639.6 crore in the previous year.

The company's earnings before interest, taxes, depreciation and amortisation (EBITDA) of ₹183.8 crore was up 36.6% from ₹134.6 crore in the first quarter last fiscal.

Inox Wind's EBITDA margins expanded to 22.2% from 21.1% in the year-ago period.

The company took a deferred tax charge of ₹40 crore. The charge reversal of the deferred tax assets has been recognised in the previous years.

The merger of Inox Wind Energy into Inox Wind Ltd. was also completed in the first quarter.

Inox Wind is targeting more than 2 GW of annual execution in FY27.

Its new nacelle plant, transformer manufacturing unit and crane services have been operationalised in the first quarter.

Of the nine analysts that have coverage on Inox Wind, eight have a "buy" rating and one has a "hold" rating.

Shares of Inox Wind were down 3.72% from their opening highs. The stock was trading 1.19% up at ₹138.66 apiece around 10.10 am on Monday, The stock has declined 15.8% in the past month and 26.1% this year, so far.

Also Read: Voltas, Blue Star, PG Electroplast shares gain up to 10% on hopes of GST rate rationalisation

However, Nuvama has maintained its "buy" recommendation on the stock, but the price target was cut to ₹190 from ₹236. Despite the cut, Nuvama's revised target implies a potential upside of 39% for Inox Wind from current levels.

Nuvama said Inox Wind reported modest execution in the June quarter at 146 mega watt (MW) in comparison to the consensus estimate of 180 MW.

It said the company's muted revenue of ₹830 crore during the June quarter, was offset by higher operating profit margin at 22.2%.

Order intake was soft at 51 MW, taking the order book to 3.1 GW, with an execution period of over 24 months, Nuvama said. The brokerage has cut its financial year 2026 and 2027 execution timelines to 1.1 GW and 1.8 GW from 1.2 GW and 2 GW respectively.

First quarter performance

Inox Wind's consolidated profit after tax increased to ₹105.8 crore in the June quarter from ₹10.3 crore in the previous year. Profitability was aided by higher other income, which increased to ₹36.3 crore from ₹15.1 crore last year. Finance costs decreased to ₹33.8 crore in the June quarter from ₹55.8 crore.

Its revenue for the first quarter increased 29.2% to ₹826.3 crore from ₹639.6 crore in the previous year.

The company's earnings before interest, taxes, depreciation and amortisation (EBITDA) of ₹183.8 crore was up 36.6% from ₹134.6 crore in the first quarter last fiscal.

Inox Wind's EBITDA margins expanded to 22.2% from 21.1% in the year-ago period.

The company took a deferred tax charge of ₹40 crore. The charge reversal of the deferred tax assets has been recognised in the previous years.

The merger of Inox Wind Energy into Inox Wind Ltd. was also completed in the first quarter.

Inox Wind is targeting more than 2 GW of annual execution in FY27.

Its new nacelle plant, transformer manufacturing unit and crane services have been operationalised in the first quarter.

Of the nine analysts that have coverage on Inox Wind, eight have a "buy" rating and one has a "hold" rating.

Shares of Inox Wind were down 3.72% from their opening highs. The stock was trading 1.19% up at ₹138.66 apiece around 10.10 am on Monday, The stock has declined 15.8% in the past month and 26.1% this year, so far.

Also Read: Voltas, Blue Star, PG Electroplast shares gain up to 10% on hopes of GST rate rationalisation