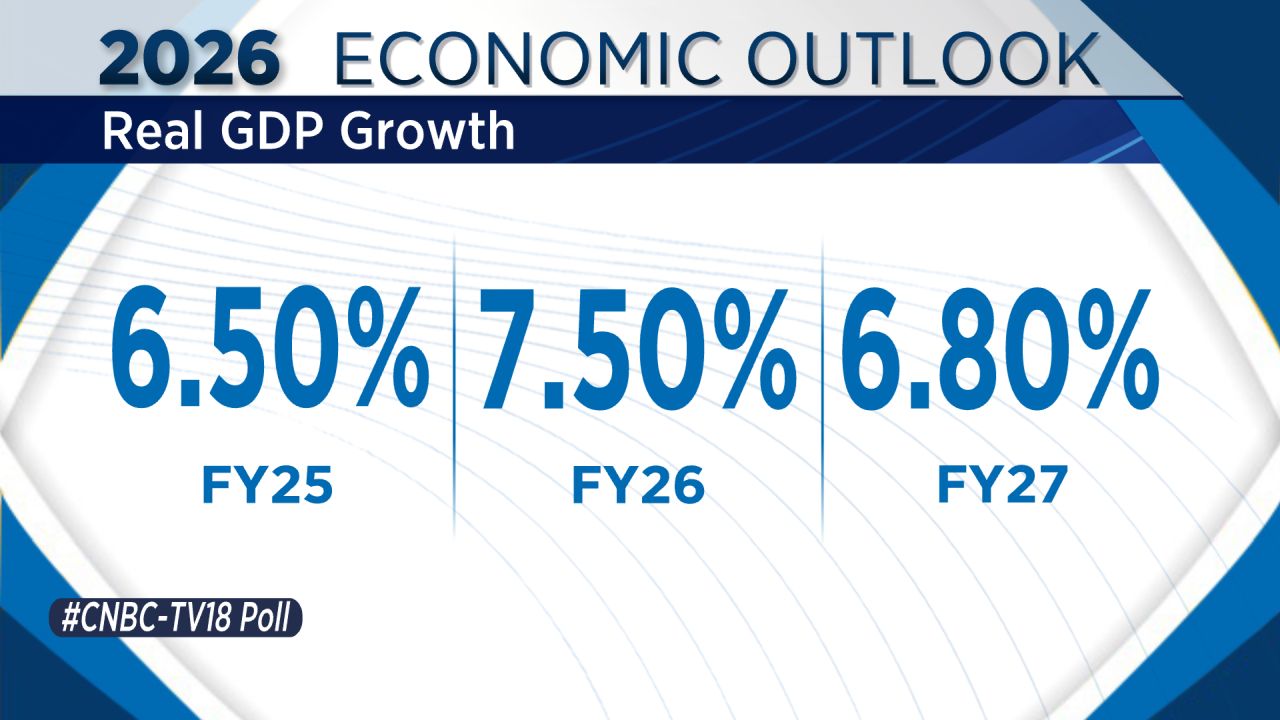

A CNBC-TV18 poll of leading economists shows India’s GDP growth averaging 6.8% in FY27, down from about 7.5% in the current year.

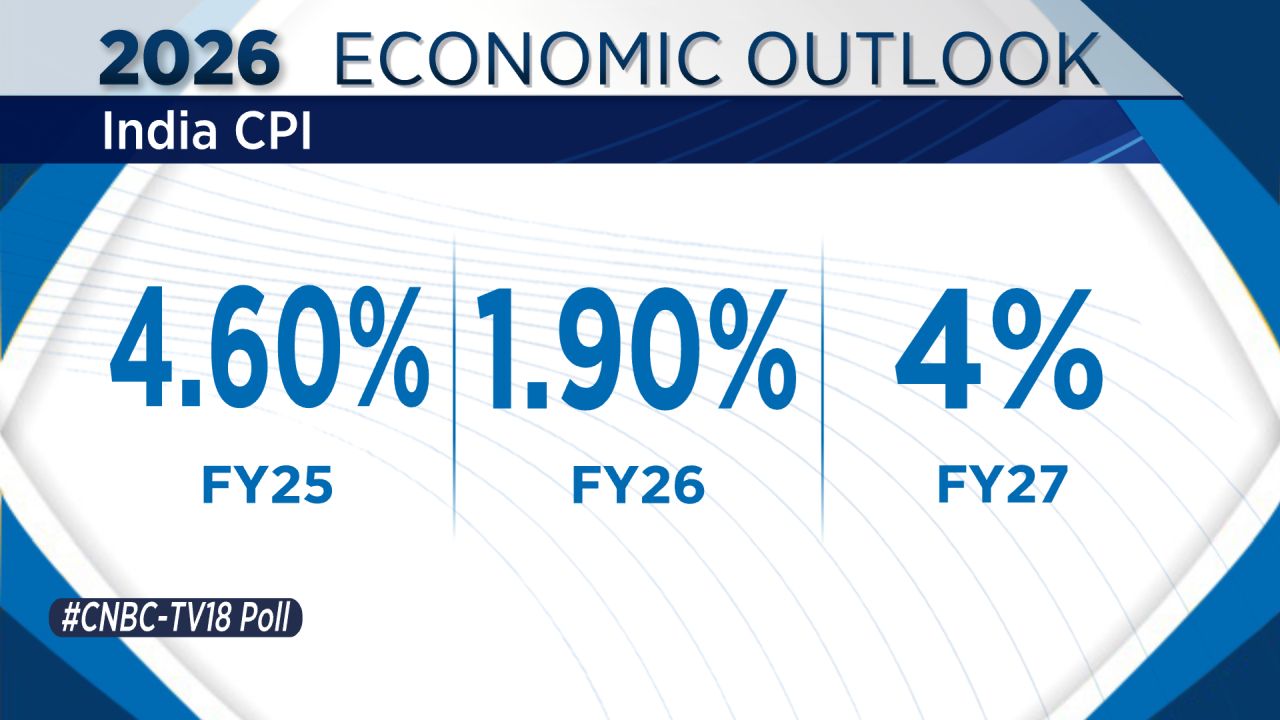

However, opinions remain divided, with some economists expecting growth closer to 6.5%, while others see it staying above 7%. Inflation expectations are more stable, with most economists projecting CPI inflation around 4% next year.

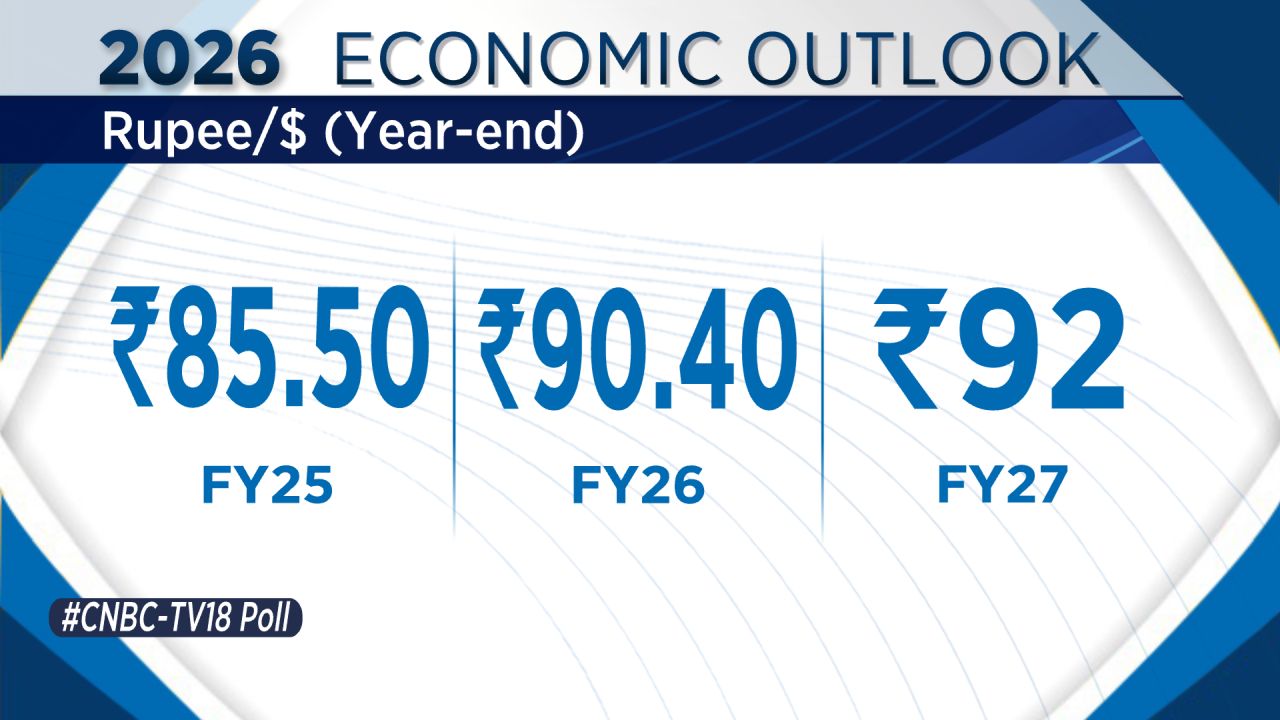

Sonal Verma, Managing Director and Chief Economist for India and Asia ex-Japan at Nomura, addressed the recent weakness in the rupee and the outlook for the balance of payments (BoP).

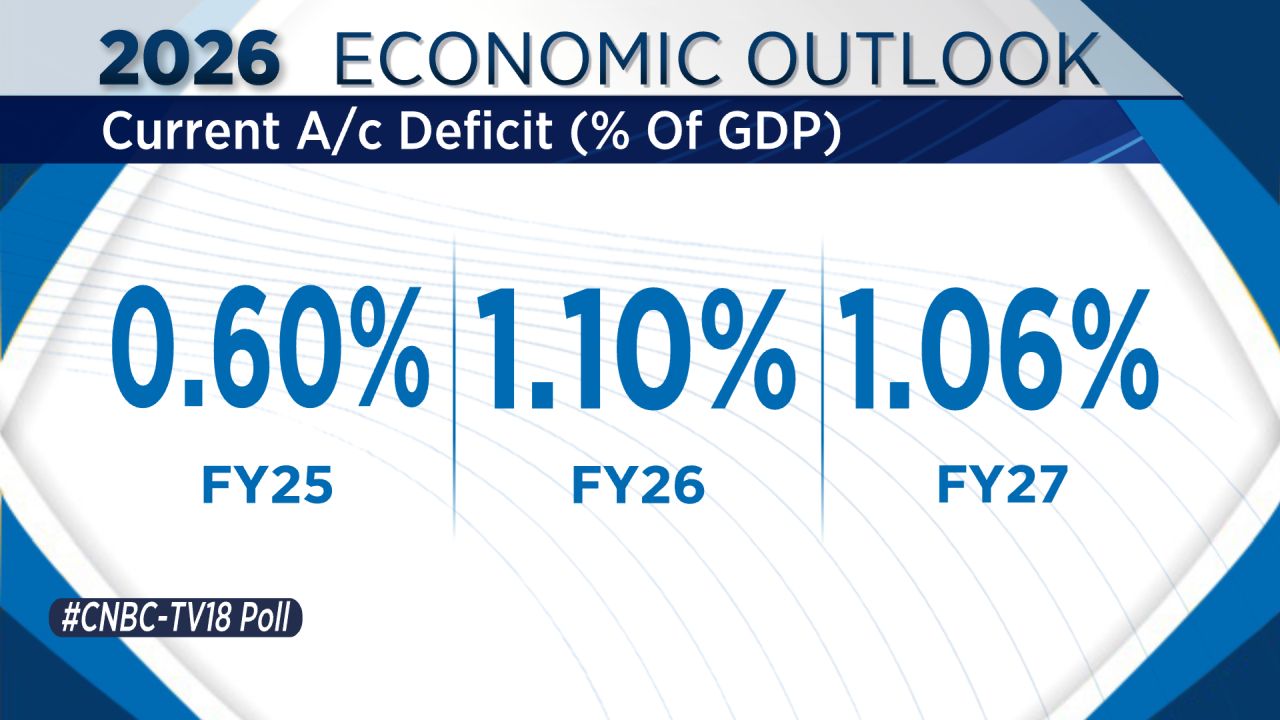

She expressed a baseline expectation for improvement over the next 12 months. "The challenge has been on funding," Verma noted, but pointed to a low current account deficit (CAD), estimated between 0.6% and 0.8% of GDP for FY26.

She identified two potential catalysts for change: renewed Foreign Portfolio Investor (FPI) interest in equities, as many negatives are priced in, and significant FPI bond inflows. "There is a possibility that India could get included in the Bloomberg Global Aggregate Index… potentially it can lead to over 20 billion dollar in inflow," she stated.

Verma concluded that this, combined with a sub-1% CAD, should ease funding concerns, and the weaker currency could also help auto-correct imbalances by making imports more expensive.

On the fiscal front, Soumyakanti Ghosh, Group Chief Economic Advisor of SBI, expressed confidence in the government's fiscal consolidation. "The centre has been on a positive glide path in the last four years," he said, bringing the deficit down from 9.2% to 4.4%.

Ghosh believes that despite revenue pressures, expenditure management will ensure India meets its targets. He stressed that the debt-to-GDP ratio is now a prime target, and adherence to its glide path is crucial.

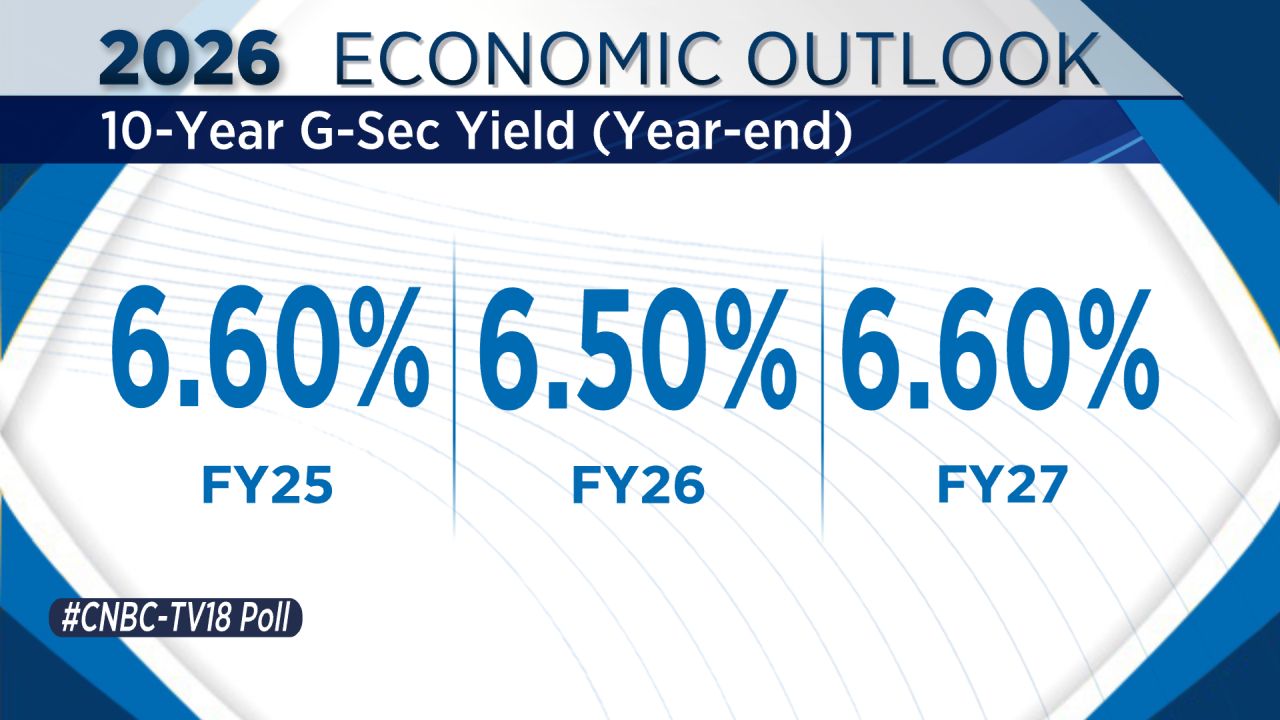

Ghosh estimated the total gross borrowing for the centre and states at ₹27-28 trillion, lower than the poll's ₹30 trillion estimate.

He anticipates the RBI will need to perform some "heavy lifting" through Open Market Operations (OMOs) to the tune of ₹1.5-2 trillion next year to manage market appetite.

On bond yields, Ghosh said the 10-year government bond yield is likely to remain broadly stable, with limited upside.

Mridul Saggar, Former RBI Executive Director, weighed in on inflation and nominal GDP growth. He expects CPI inflation to "hover around the target," projecting a range of 3.8% to 4.2% for the next year. "I am not too concerned about inflation at the moment," he remarked.

On nominal GDP, he offered a more optimistic view than the poll's average of 9.7%, suggesting it could track between 10.5% and 11%. While acknowledging that "growth is at risk," his baseline scenario still points to real GDP growth of around 7%.

For the entire discussion, watch the accompanying video

Live stock market updates—follow our blog