What is the story about?

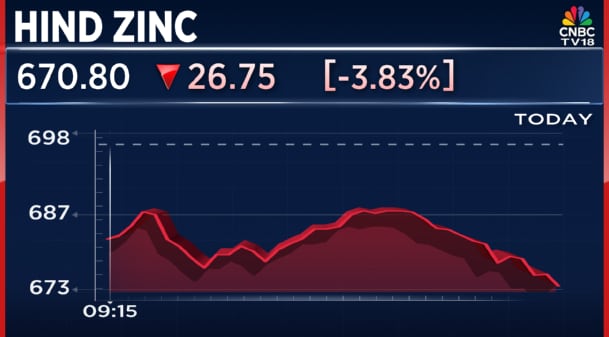

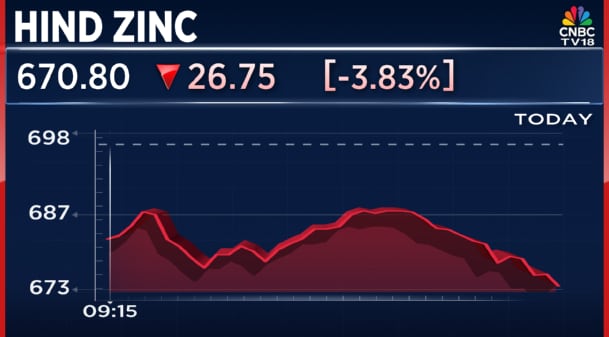

Shares of Hindustan Zinc slipped around 4% on Thursday, January 22, after a sharp decline in silver prices weighed on sentiment. Silver prices on the MCX fell over 2%, while silver-linked exchange traded funds saw steep losses in the range of 10-14%.

Hindustan Copper Ltd. also came under pressure, with the PSU stock dropping as much as 5% from the day's highs. The stock has now declined in four of the last five trading sessions.

The sell-off in silver ETFs comes amid a sharp build-up in leveraged positions over recent weeks.

Disclosures from the Margin Trading Facility book, published daily by the National Stock Exchange, show that leveraged bets in silver ETFs have increased multi-fold over the past 38 sessions starting December 1.

Interestingly, the correction in domestic silver-linked instruments played out despite global spot silver prices not seeing a comparable decline, even as risk-off sentiment had eased overnight.

Risk appetite saw a modest recovery after US President Donald Trump said he would not use force to acquire Greenland and clarified that the proposed 10% tariffs on European allies over the issue would not be implemented from February 1.

Market concerns around leverage were also pointed out by Zerodha founder and CEO Nithin Kamath, who flagged risks associated with the rapid growth of margin trading.

In a post on social media platform X, Kamath said the Margin Trading Facility has expanded nearly five-fold since the Covid-19 pandemic, a trend CNBC-TV18 has reported on multiple times in 2025.

Kamath warned that while liquidity tends to remain ample during market rallies, it dries up quickly during drawdowns, raising the risk of forced selling.

He cautioned that the next major market correction could trigger synchronized liquidations of leveraged positions, exacerbating volatility.

"We haven't seen a 2008, 2015, or COVID-type event since MTF scaled up. When we do, it will cause mayhem—not because any broker fails, but because forced selling into illiquid markets will cascade," Kamath wrote on X.

Hindustan Copper Ltd. also came under pressure, with the PSU stock dropping as much as 5% from the day's highs. The stock has now declined in four of the last five trading sessions.

The sell-off in silver ETFs comes amid a sharp build-up in leveraged positions over recent weeks.

Disclosures from the Margin Trading Facility book, published daily by the National Stock Exchange, show that leveraged bets in silver ETFs have increased multi-fold over the past 38 sessions starting December 1.

Interestingly, the correction in domestic silver-linked instruments played out despite global spot silver prices not seeing a comparable decline, even as risk-off sentiment had eased overnight.

Risk appetite saw a modest recovery after US President Donald Trump said he would not use force to acquire Greenland and clarified that the proposed 10% tariffs on European allies over the issue would not be implemented from February 1.

Market concerns around leverage were also pointed out by Zerodha founder and CEO Nithin Kamath, who flagged risks associated with the rapid growth of margin trading.

In a post on social media platform X, Kamath said the Margin Trading Facility has expanded nearly five-fold since the Covid-19 pandemic, a trend CNBC-TV18 has reported on multiple times in 2025.

Kamath warned that while liquidity tends to remain ample during market rallies, it dries up quickly during drawdowns, raising the risk of forced selling.

He cautioned that the next major market correction could trigger synchronized liquidations of leveraged positions, exacerbating volatility.

"We haven't seen a 2008, 2015, or COVID-type event since MTF scaled up. When we do, it will cause mayhem—not because any broker fails, but because forced selling into illiquid markets will cascade," Kamath wrote on X.