What is the story about?

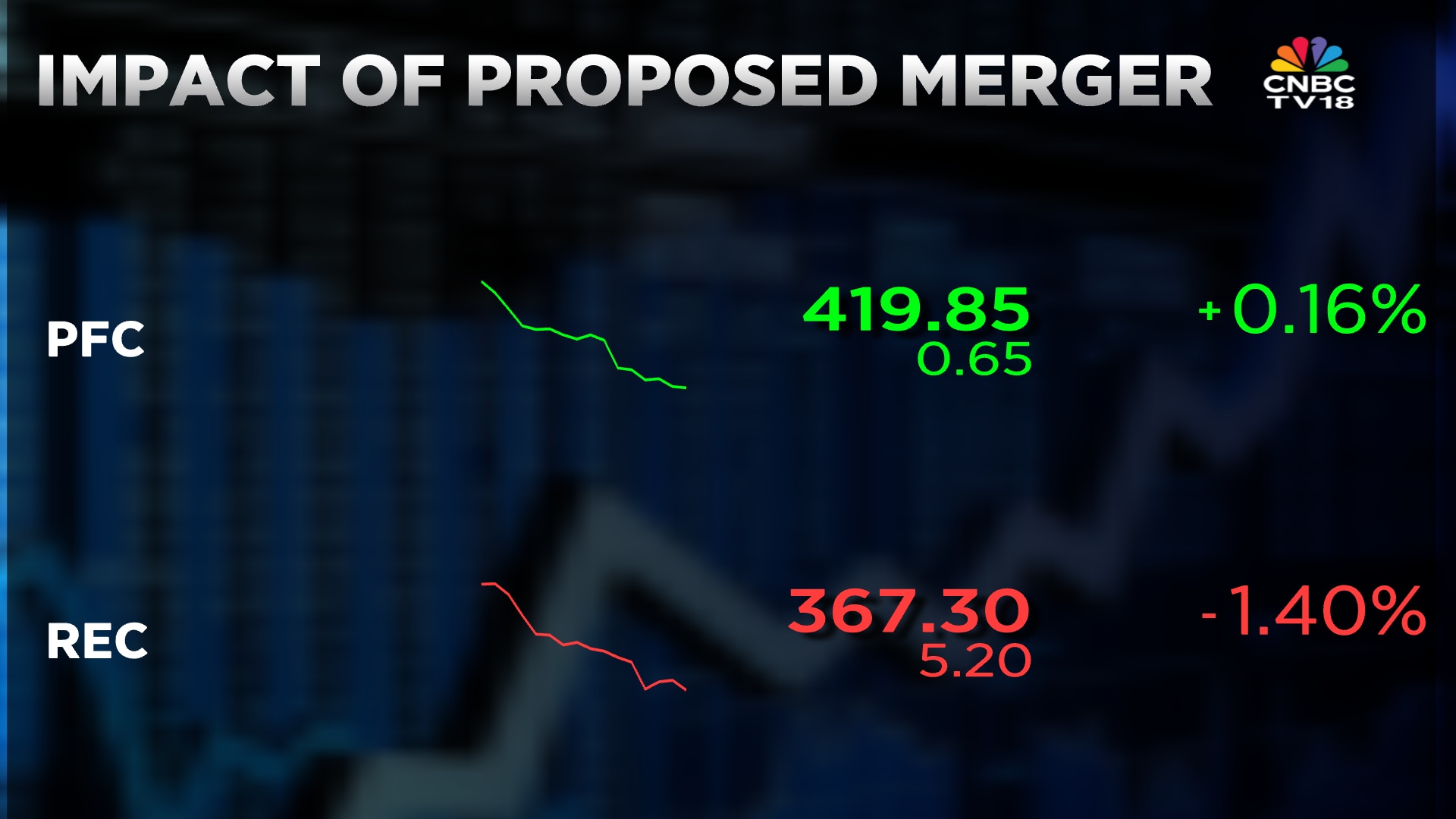

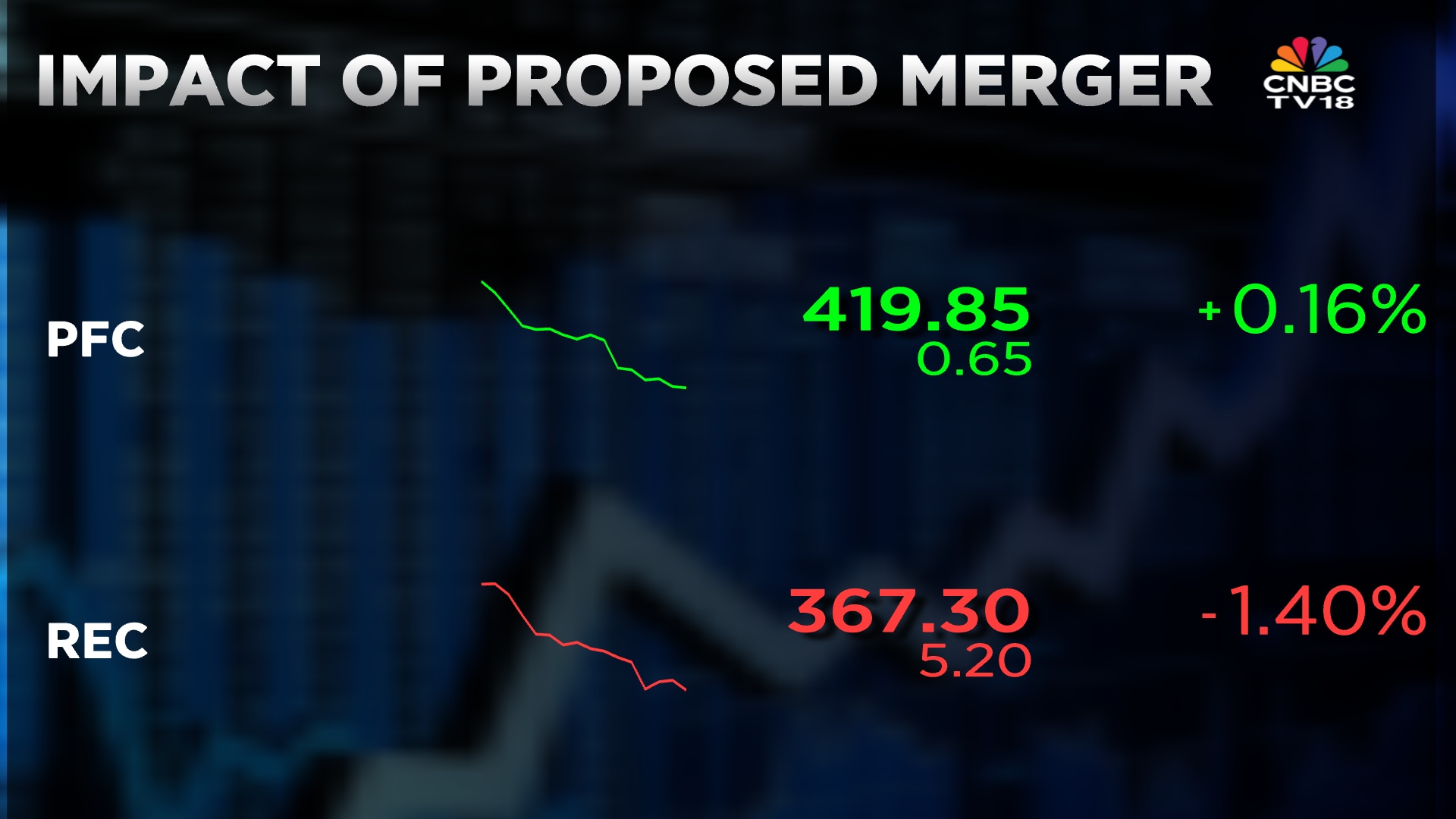

Shares of Power Finance Corporation Ltd. (PFC) jumped while those of Rural Electrification Corporation Ltd. (REC) fell in early trade on Feb 9, the first trading after the government announced the merger of the two state-owned companies.

While both stocks are cheap by valuation, the move will yield a bigger benefit for PFC shareholders, according to a Bernstein analyst.

PFC already owns 52.6% stake in REC. Considering the share swap at the current market prices of PFC to acquire the remaining stake in REC, the Centre's holding in PFC will fall to 42% from the current 56%.

While more details of the proposed merger process is awaited, Emkay Global, a Mumbai-based broking firm, charted three possible ways this merger :

A re-rating of the merged entity will be contingent on capacity expansion by coal-run power utilities (largely owned by state governments).

Put together, the two companies have a loan book of over ₹11 lakh crore.

In the second quarter, PFC's consolidated loan book had increased 10%, in the first quarter it was up 12.9% and in the preceding quarter it had increased 12%.

Also Read: Kotak Mahindra Bank shares in focus after it clarifies on IDBI Bank bid

While both stocks are cheap by valuation, the move will yield a bigger benefit for PFC shareholders, according to a Bernstein analyst.

Share prices as at 9:30 am on Feb 9.

PFC already owns 52.6% stake in REC. Considering the share swap at the current market prices of PFC to acquire the remaining stake in REC, the Centre's holding in PFC will fall to 42% from the current 56%.

While more details of the proposed merger process is awaited, Emkay Global, a Mumbai-based broking firm, charted three possible ways this merger :

- A large-scale 'buyback' by PFC and REC, with the promoters not participating

- A large-scale (₹35,000 crore at current price) capital infusion by the Centre in PFC via preferential issuance

- Amending The Companies Act, 2013, as envisaged in the Economic Survey 2025-26, to allow the Centre's stake to increase 26% in a 'government company'.

A re-rating of the merged entity will be contingent on capacity expansion by coal-run power utilities (largely owned by state governments).

Put together, the two companies have a loan book of over ₹11 lakh crore.

In the second quarter, PFC's consolidated loan book had increased 10%, in the first quarter it was up 12.9% and in the preceding quarter it had increased 12%.

Also Read: Kotak Mahindra Bank shares in focus after it clarifies on IDBI Bank bid