Sengupta believes the central bank might prefer to wait and watch how the growth and inflation data evolve over the coming months, possibly moving in October or December instead. “We don't think there's a rate cut tomorrow,” he said, but added that a change in forecasts is likely.

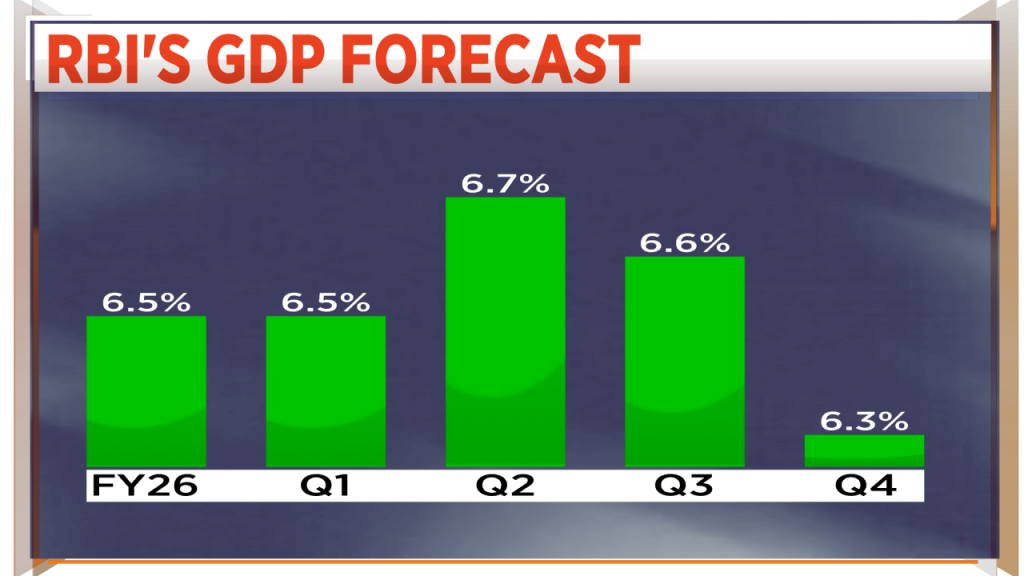

He expects the RBI to sharply lower its inflation forecast, currently at 3.7%, bringing it closer to 3% due to the steep fall in vegetable prices and overall contained food inflation. At the same time, a minor downward revision in the gross domestic product (GDP) growth forecast is also on the cards, especially given the added uncertainty from the recent 25% US tariff hike on Indian goods. He highlighted that while the immediate impact on GDP is limited, “this will likely not be the final word on tariffs,” suggesting more policy risk ahead.

More important than the rate decision itself, Sengupta said, is the language the RBI uses. “Communication tomorrow is much more important than whether they deliver that 25 basis points of rate cut or not,” he said, adding that markets need to believe there is room for more easing ahead for effective policy transmission.

Also Read: Dollar likely to regain strength after Fed ends rate cuts: Standard Chartered

B Prasanna, Head of Global Markets Group at ICICI Bank, who also joined the discussion, stated the importance of RBI’s liquidity strategy, how it manages surplus liquidity and whether it targets the weighted average call rate or another benchmark, as a key market signal beyond just rate action.

Prasanna said bond yields are likely to head lower in the near term, but the move may not be significant. “As far as duration is concerned, there is not a significant, large move that we expect,” he said, suggesting the biggest impact will be seen in short to medium-term bonds.

Also Read: RBI MPC meet starts today: Market looks for signs of another rate cut

Prasanna also expects the Indian rupee to remain under pressure despite broad dollar weakness globally. He attributed this to persistent foreign institutional investor (FII) and foreign direct investment (FDI) outflows, as well as concerns around export competitiveness due to the tariff hike. “The rupee needs to depreciate in order to regain competitiveness from the exporters' side,” he explained, adding that the RBI’s ongoing dollar buying also contributes to the rupee's weakness.

For the entire discussion, watch the accompanying video

Catch all the latest updates from the stock market here