What is the story about?

Gold demand in India made a strong comeback in October, with jewellers reporting their best Diwali sales ever despite record prices, according to Sachin Jain, Managing Director of the World Gold Council (WGC). Jain said the festive surge capped a quarter of mixed trends — muted jewellery demand earlier in the year, but record-high global investment and renewed consumer enthusiasm heading into the wedding season.

Globally, gold saw its strongest quarter in history. “We’ve witnessed the biggest quarter yet in history — 1,313 tonne of global demand — largely led by investment demand of over 524 tonne,” Jain said. However, he acknowledged that “it’s not just in India, but globally, we’ve witnessed a decline in jewellery demand… which was expected with the current pricing of gold.”

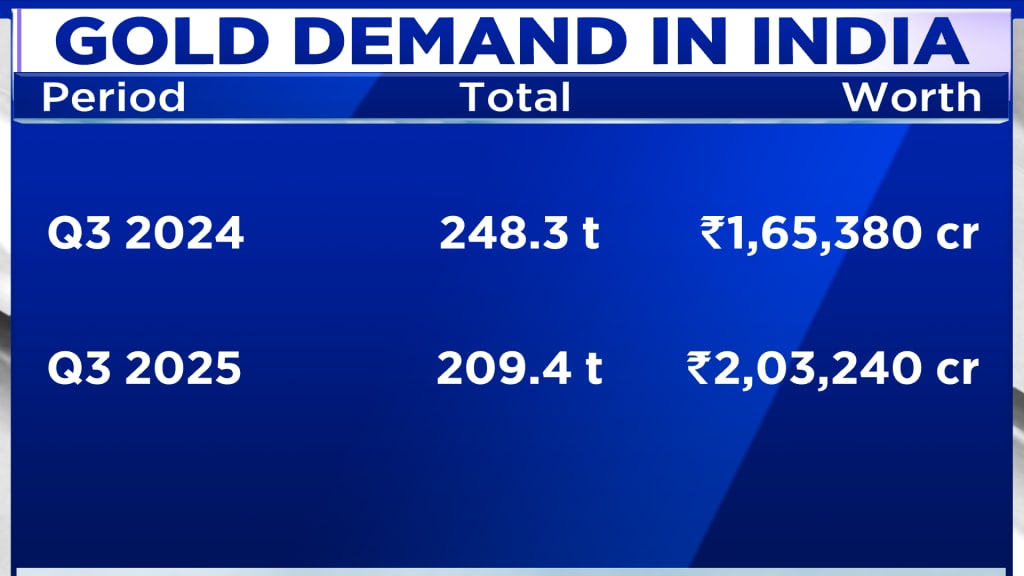

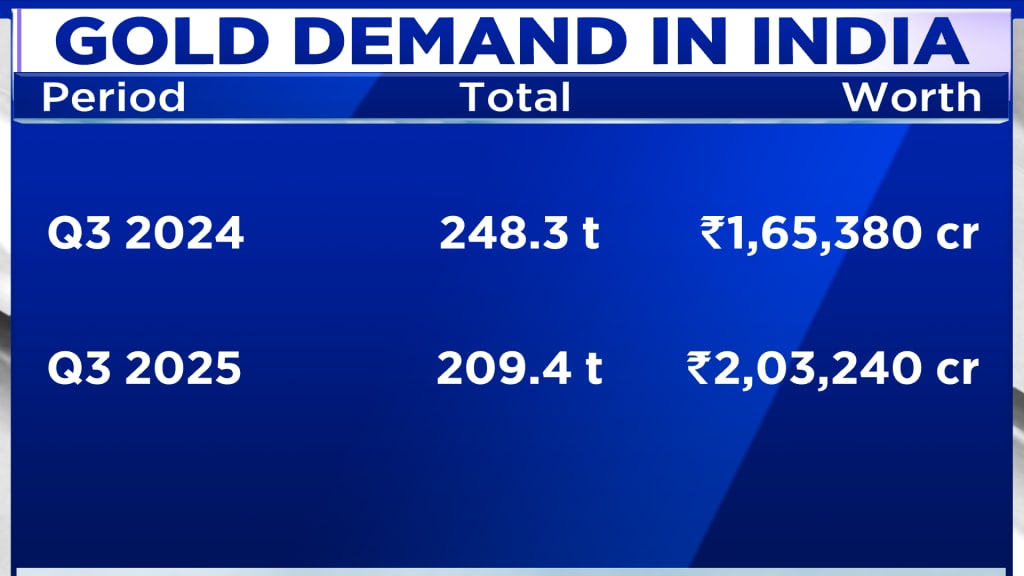

Reflecting on India’s numbers, Jain explained that part of last year’s strong demand was linked to the historic import duty cut announced in June 2024. “All that benefit and all that sort of euphoria that we witnessed of the duty drop from 15% to 6% was reflected in Q3 2024,” he said, adding that the surge was concentrated around that period.

Looking at 2025, Jain noted a correction in volumes but steady value terms. “From a volume point of view, we are about 31% down, which is significant. Value-wise, we’re still at about the same level of ₹1.15 lakh crore or so, which is great,” he said. He attributed this to an early Diwali and seasonal buying patterns, adding that “October has been a rampant increase and great dominant consumption that we witnessed at, of course, the all-time high prices.”

Also Read: Gold’s rally backed by fundamentals, not froth: World Gold Council’s Sachin Jain

Jain highlighted a notable shift toward investment-driven purchases. “The investment demand has touched 91.6 tonne, which is phenomenally high… in terms of value, it’s about 74.5% up and totalling about ₹88,970 crore,” he said. This demand was led by bullion, bars, coins, and a growing share of ETFs.

Interestingly, despite record prices, recycling activity fell. “Our numbers report a 7% decline… the recycling number going down is a clear indication of the confidence people have on gold as a commodity,” Jain observed. He added that while cash recycling dipped, the exchange of old gold for new jewellery likely rose sharply, with estimates “upwards of 40–45% of old gold converting into new, fresh designs.”

October’s festive boom has set a strong tone for the upcoming wedding season. “October has been extremely, extremely, extremely strong… people have seen the best Diwali yet,” Jain said, citing feedback from jewellers across the country.

Also Read: Gold prices may stabilise near $4,000 an ounce, says HSBC strategist

He also pointed to strong demand among high-value buyers. “Consumers who tend to buy higher value goods — 100 to 150 grammes or about half a kilogram of jewellery — that segment has done continuously very well,” he said.

Jain stated that the sentiment toward gold remains deeply entrenched in Indian households. “The underlying strength and the confidence of the consumer in gold continues to be very strong,” he said, expressing optimism that the momentum will carry through the wedding season.

For the entire interview, watch the accompanying video

Catch all the latest updates from the stock market here

Globally, gold saw its strongest quarter in history. “We’ve witnessed the biggest quarter yet in history — 1,313 tonne of global demand — largely led by investment demand of over 524 tonne,” Jain said. However, he acknowledged that “it’s not just in India, but globally, we’ve witnessed a decline in jewellery demand… which was expected with the current pricing of gold.”

Reflecting on India’s numbers, Jain explained that part of last year’s strong demand was linked to the historic import duty cut announced in June 2024. “All that benefit and all that sort of euphoria that we witnessed of the duty drop from 15% to 6% was reflected in Q3 2024,” he said, adding that the surge was concentrated around that period.

Looking at 2025, Jain noted a correction in volumes but steady value terms. “From a volume point of view, we are about 31% down, which is significant. Value-wise, we’re still at about the same level of ₹1.15 lakh crore or so, which is great,” he said. He attributed this to an early Diwali and seasonal buying patterns, adding that “October has been a rampant increase and great dominant consumption that we witnessed at, of course, the all-time high prices.”

Also Read: Gold’s rally backed by fundamentals, not froth: World Gold Council’s Sachin Jain

Jain highlighted a notable shift toward investment-driven purchases. “The investment demand has touched 91.6 tonne, which is phenomenally high… in terms of value, it’s about 74.5% up and totalling about ₹88,970 crore,” he said. This demand was led by bullion, bars, coins, and a growing share of ETFs.

Interestingly, despite record prices, recycling activity fell. “Our numbers report a 7% decline… the recycling number going down is a clear indication of the confidence people have on gold as a commodity,” Jain observed. He added that while cash recycling dipped, the exchange of old gold for new jewellery likely rose sharply, with estimates “upwards of 40–45% of old gold converting into new, fresh designs.”

October’s festive boom has set a strong tone for the upcoming wedding season. “October has been extremely, extremely, extremely strong… people have seen the best Diwali yet,” Jain said, citing feedback from jewellers across the country.

Also Read: Gold prices may stabilise near $4,000 an ounce, says HSBC strategist

He also pointed to strong demand among high-value buyers. “Consumers who tend to buy higher value goods — 100 to 150 grammes or about half a kilogram of jewellery — that segment has done continuously very well,” he said.

Jain stated that the sentiment toward gold remains deeply entrenched in Indian households. “The underlying strength and the confidence of the consumer in gold continues to be very strong,” he said, expressing optimism that the momentum will carry through the wedding season.

For the entire interview, watch the accompanying video

Catch all the latest updates from the stock market here