What is the story about?

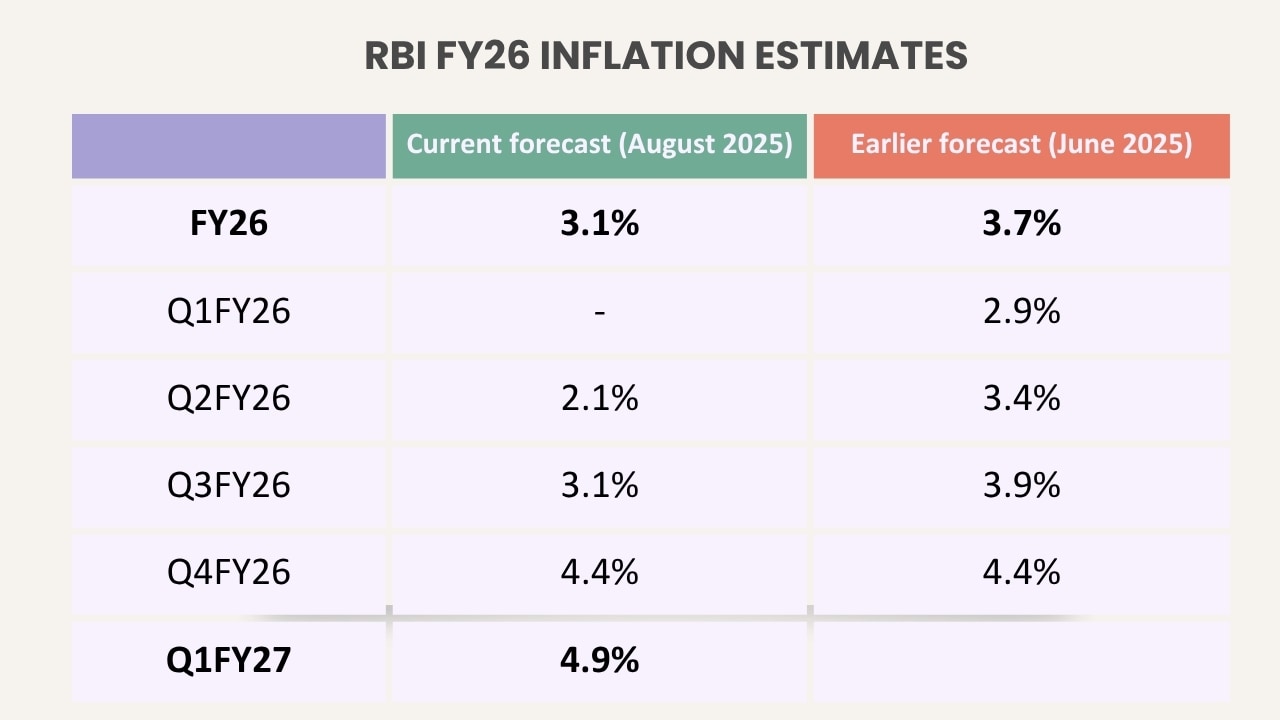

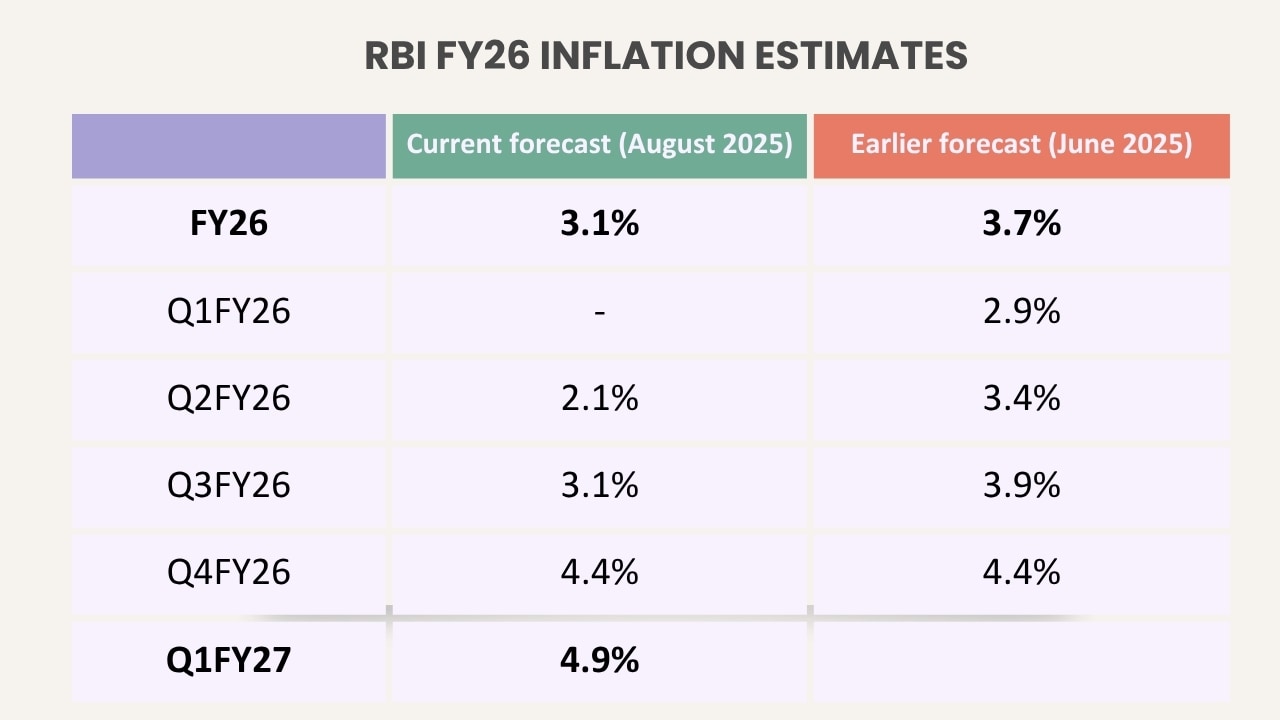

The Reserve Bank of India’s Monetary Policy Committee (RBI MPC) on August 6 further lowered its inflation forecast for the financial year ending March 2026 to 3.1%, down from 3.7% projected in June, as food prices continue to fall and headline inflation stays well below target.

The central bank, however, expects inflation to inch up towards the end of the year to 4.4%, and further up to 4.9% in the first quarter of the financial year ending March 2027, due to seasonal trends and base effects.

That’s broadly in line with expectations. Nearly 90% of the economists polled by CNBC-TV18 had predicted the RBI would revise the forecast down to 3.0-3.3%.

Catch all live updates of the RBI Monetary Policy August 2025

"Inflation outlook has become more benign. Favorable base effect and healthy southwest monsoon are helping ease inflation," said RBI Governor Sanjay Malhotra.

In a recent interview with CNBC-TV18, Malhotra highlighted that the MPC does not favour one objective over the other: "One cannot say inflation is more important than growth, it’s always the mix of both factors." He said decisions will remain data-driven, with more weight given to sustained trends than short-term blips.

Also Read: RBI Governor Sanjay Malhotra on rates, inflation, reforms, and growth

Retail inflation has already cooled sharply. The June CPI reading dropped to 2.1%, the lowest since January 2019, and well below May’s reading of 2.82%. Food inflation turned negative at -1.06%, driven by a steep 19% fall in vegetable prices and a nearly 12% drop in pulses.

Economists believe the latest numbers open the door for further policy easing later this year.

“We expect full-year CPI inflation to remain below the RBI's estimate of 3.7%, and hence do not rule out the possibility of another rate cut post-monsoon,” said Garima Kapoor of Elara Capital.

The inflation trend was broad-based. Rural inflation fell to 1.72% from 2.59% in May, while urban inflation eased to 2.56% from 3.07%. Core categories such as housing, fuel, and clothing also saw limited price pressure.

The RBI MPC also unanimously voted to keep the benchmark repo rate unchanged at 5.5%, while retaining its neutral stance. The GDP growth forecast for the year was also retained at 6.5%.

The central bank, however, expects inflation to inch up towards the end of the year to 4.4%, and further up to 4.9% in the first quarter of the financial year ending March 2027, due to seasonal trends and base effects.

RBI Monetary Policy August 2025

That’s broadly in line with expectations. Nearly 90% of the economists polled by CNBC-TV18 had predicted the RBI would revise the forecast down to 3.0-3.3%.

Catch all live updates of the RBI Monetary Policy August 2025

"Inflation outlook has become more benign. Favorable base effect and healthy southwest monsoon are helping ease inflation," said RBI Governor Sanjay Malhotra.

In a recent interview with CNBC-TV18, Malhotra highlighted that the MPC does not favour one objective over the other: "One cannot say inflation is more important than growth, it’s always the mix of both factors." He said decisions will remain data-driven, with more weight given to sustained trends than short-term blips.

Also Read: RBI Governor Sanjay Malhotra on rates, inflation, reforms, and growth

Retail inflation has already cooled sharply. The June CPI reading dropped to 2.1%, the lowest since January 2019, and well below May’s reading of 2.82%. Food inflation turned negative at -1.06%, driven by a steep 19% fall in vegetable prices and a nearly 12% drop in pulses.

Economists believe the latest numbers open the door for further policy easing later this year.

“We expect full-year CPI inflation to remain below the RBI's estimate of 3.7%, and hence do not rule out the possibility of another rate cut post-monsoon,” said Garima Kapoor of Elara Capital.

The inflation trend was broad-based. Rural inflation fell to 1.72% from 2.59% in May, while urban inflation eased to 2.56% from 3.07%. Core categories such as housing, fuel, and clothing also saw limited price pressure.

The RBI MPC also unanimously voted to keep the benchmark repo rate unchanged at 5.5%, while retaining its neutral stance. The GDP growth forecast for the year was also retained at 6.5%.