What is the story about?

The Indian cement sector is likely to see a weak third quarter on profitability, but conditions should improve meaningfully in the fourth quarter, according to Pulkit Patni, India Industrials Analyst at Goldman Sachs.

Over the longer term, he expects the sector's profitability to improve on a more structural basis, supported by steady demand, cost efficiencies, and ongoing consolidation, which continues to favour larger players.

In the near-term, Patni said pricing pressure is expected to weigh on margins in the third quarter, even as volumes have held up better than anticipated. "What started off as a weak October picked up at the margin in November and December volumes have turned out to be really strong," he stated.

Patni expects this volume momentum to extend to the end of the quarter four. Companies are also likely to attempt price increases early in the quarter. However, he cautioned that as the financial year draws to a close, a renewed focus on pushing volumes could once again put pressure on prices.

"Net-net, we expect a weak third quarter because of prices and a much better fourth quarter supported by both slightly better prices as well as better volumes," Patni summarised.

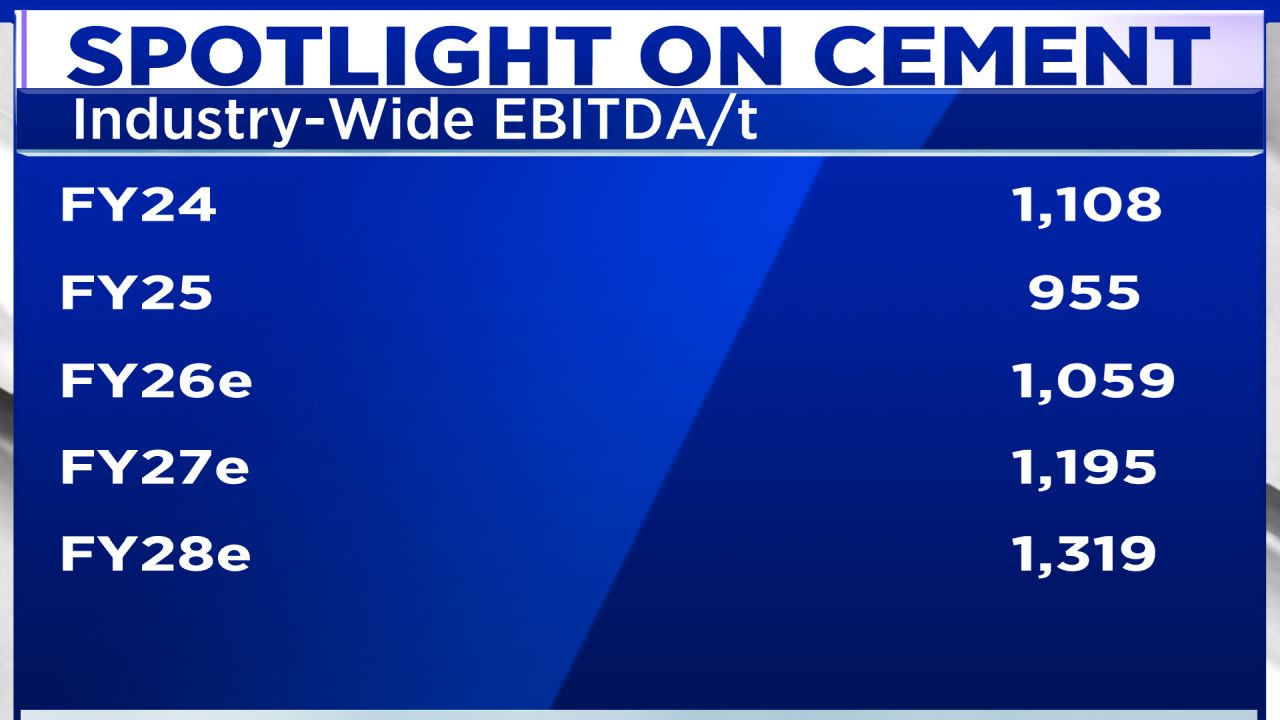

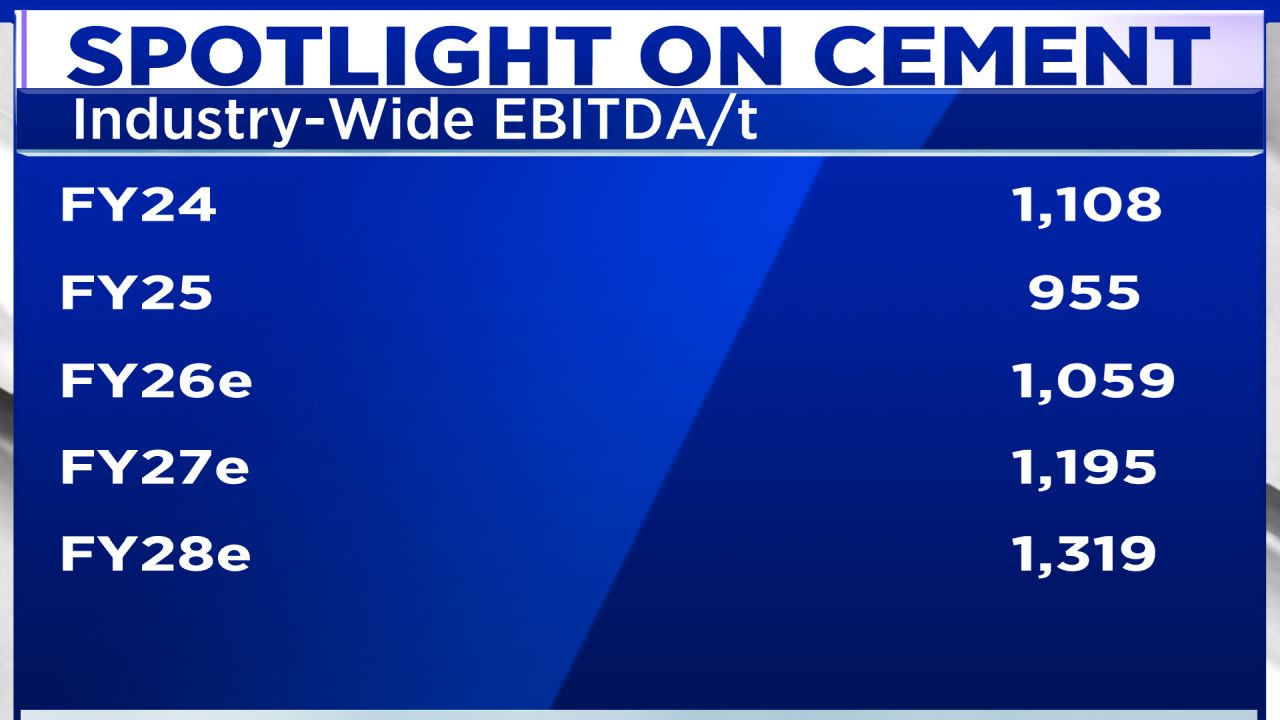

Looking ahead over the next couple of years to fiscal year 2026, Goldman Sachs projects an improvement of ₹200-250 per tonne in earnings before interest, tax, depreciation, and amortisation (EBITDA) for the industry.

Patni explained that this forecast is based on several factors, starting with a favourable low base from the current, subdued year. He noted a near-term headwind from significant new capacity additions expected over the next six to nine months, which will likely keep prices subdued in the first half of the next fiscal year.

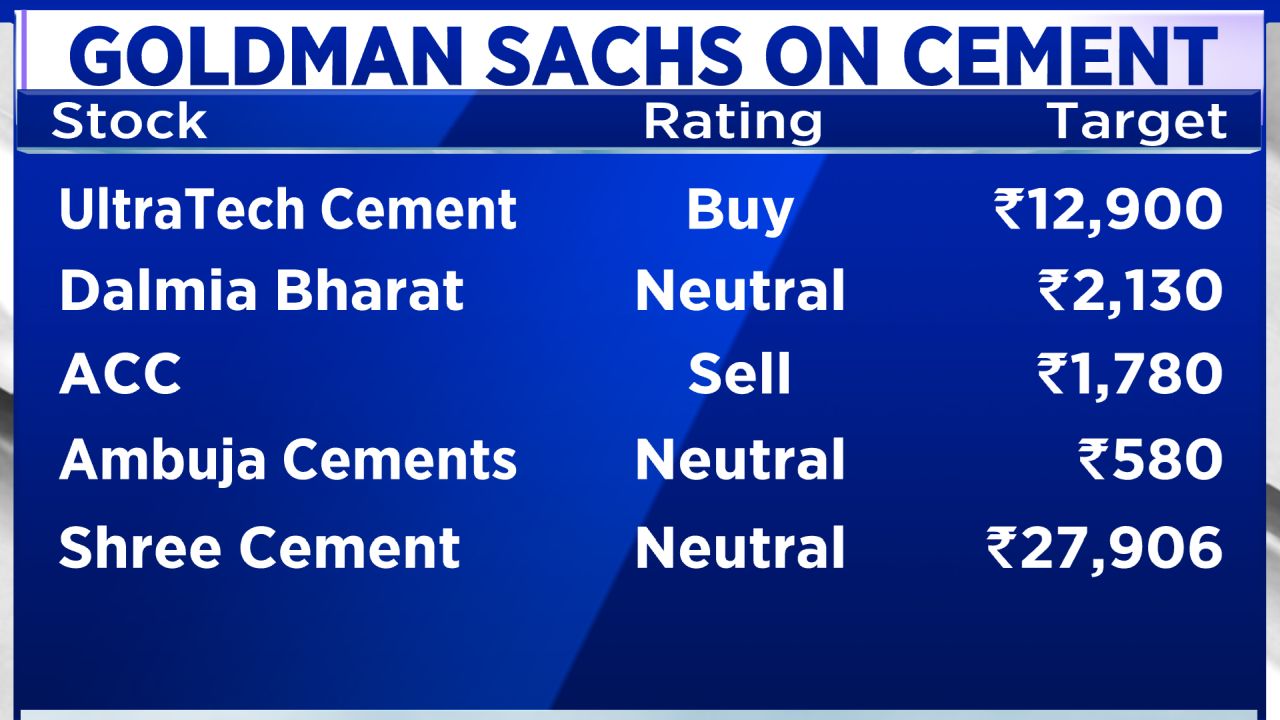

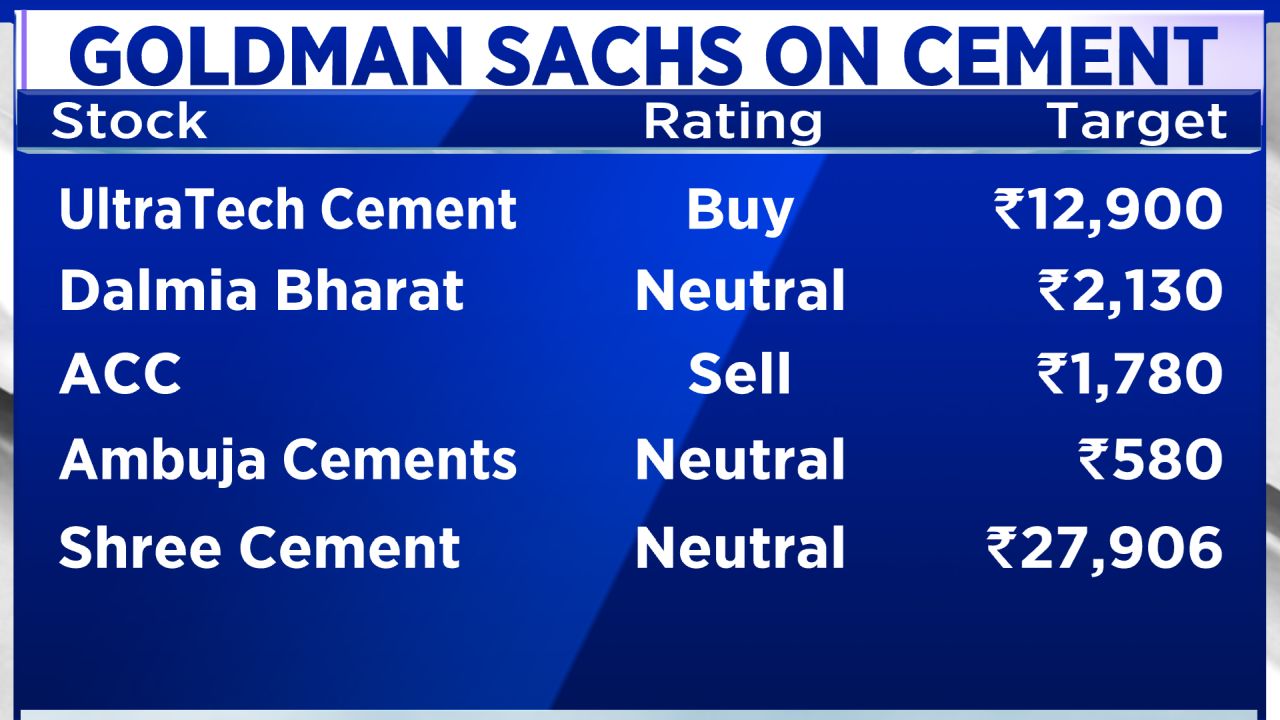

Despite this, Patni believes the bigger picture for the sector remains intact. He highlighted expectations for demand to grow at a compound annual growth rate (CAGR) of 7-8% over the next couple of years. Furthermore, he described the sector as becoming a "big boys' club," where larger companies are actively working to lower costs.

These cost-saving measures include transitioning to green power, increasing the use of waste heat recovery systems, and optimising logistics by shifting from road to rail. Combined with the operating leverage that comes with size and scale, Patni believes the EBITDA improvement is "relatively easy" to achieve for these large players.

Consolidation remains a key structural theme. While much of the large-scale consolidation has already taken place, further deals are possible as smaller players face profitability pressure. Larger companies continue to benefit from scale, lower acquisition costs, and cheaper greenfield expansions, which should help return ratios improve over time.

On regional preferences, Goldman Sachs is cautious on North India due to heavy upcoming capacity additions, while remaining more constructive on the West and South, where demand drivers and supply conditions appear more balanced.

Get live stock market updates on our blog

Over the longer term, he expects the sector's profitability to improve on a more structural basis, supported by steady demand, cost efficiencies, and ongoing consolidation, which continues to favour larger players.

In the near-term, Patni said pricing pressure is expected to weigh on margins in the third quarter, even as volumes have held up better than anticipated. "What started off as a weak October picked up at the margin in November and December volumes have turned out to be really strong," he stated.

Patni expects this volume momentum to extend to the end of the quarter four. Companies are also likely to attempt price increases early in the quarter. However, he cautioned that as the financial year draws to a close, a renewed focus on pushing volumes could once again put pressure on prices.

"Net-net, we expect a weak third quarter because of prices and a much better fourth quarter supported by both slightly better prices as well as better volumes," Patni summarised.

Looking ahead over the next couple of years to fiscal year 2026, Goldman Sachs projects an improvement of ₹200-250 per tonne in earnings before interest, tax, depreciation, and amortisation (EBITDA) for the industry.

Patni explained that this forecast is based on several factors, starting with a favourable low base from the current, subdued year. He noted a near-term headwind from significant new capacity additions expected over the next six to nine months, which will likely keep prices subdued in the first half of the next fiscal year.

Despite this, Patni believes the bigger picture for the sector remains intact. He highlighted expectations for demand to grow at a compound annual growth rate (CAGR) of 7-8% over the next couple of years. Furthermore, he described the sector as becoming a "big boys' club," where larger companies are actively working to lower costs.

These cost-saving measures include transitioning to green power, increasing the use of waste heat recovery systems, and optimising logistics by shifting from road to rail. Combined with the operating leverage that comes with size and scale, Patni believes the EBITDA improvement is "relatively easy" to achieve for these large players.

Consolidation remains a key structural theme. While much of the large-scale consolidation has already taken place, further deals are possible as smaller players face profitability pressure. Larger companies continue to benefit from scale, lower acquisition costs, and cheaper greenfield expansions, which should help return ratios improve over time.

On regional preferences, Goldman Sachs is cautious on North India due to heavy upcoming capacity additions, while remaining more constructive on the West and South, where demand drivers and supply conditions appear more balanced.

Get live stock market updates on our blog