What are Critical Illness Riders?

A critical illness rider is an add-on to your existing insurance policy, providing a lump-sum payout if you're diagnosed with a covered critical illness. These riders act as a financial cushion during a difficult time. This extra layer of security can be a lifesaver, similar to having a good network connection when ordering your favorite street food. It means you receive funds to help cover medical expenses, lost income, and other costs, helping to alleviate financial stress during a health crisis. Remember, planning is key!

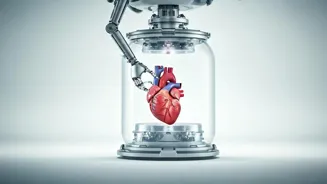

Commonly Covered Illnesses and Exclusions

Critical illness riders typically cover conditions like cancer, heart attack, stroke, kidney failure, and major organ transplants. It's like the variety you find at the local Holi celebrations – a broad spectrum! However, it's crucial to understand exclusions; these can include pre-existing conditions, certain types of cancer, and illnesses diagnosed within a waiting period. Always review the policy document carefully to be fully aware of what's covered and what’s not. Consider it as careful planning when choosing your travel destination.

Payout Structures and Benefit Amounts

Payout structures vary depending on the insurance provider and policy chosen. Generally, you receive a lump-sum payment upon diagnosis of a covered illness, which can be used as needed. The benefit amount is usually a percentage of your base insurance cover. It's similar to the different spice levels in a curry – choose what suits your needs. Some policies offer escalating benefits. Research and choose the structure and amount that suits your financial needs and planning requirements; for example, when deciding which Samosa to try.

Why Critical Illness Riders are Crucial Now

In today's world, rising healthcare costs and the prevalence of critical illnesses make these riders more important than ever. They protect your savings and provide financial stability when you need it most. It's a bit like ensuring you have access to clean drinking water – essential for your overall well-being. Additionally, with increased awareness and healthcare access, the need for this financial safety net is evident. This is particularly relevant for the younger generation.

Making an Informed Decision

Choosing a critical illness rider requires careful consideration of your needs and the policy details. Compare different plans, understand the exclusions, and consider your family's medical history and financial circumstances. Just like choosing between different types of sweets at a Diwali Mela, carefully assess all available options. Don't hesitate to seek advice from a financial advisor to ensure you choose the right plan and the level of coverage tailored to your specific requirements. Prioritize your health & financial well-being!