Health Sector Boost

One of the most noteworthy announcements from the Union Budget 2026 involved the health sector. The government decided to waive customs duty on crucial

medications used to treat cancer and rare diseases. This move aimed to reduce the cost of these life-saving drugs, potentially making them more accessible to patients. This initiative demonstrated the government's commitment to improving healthcare and providing financial relief to those battling serious illnesses. The budget’s focus on the health sector signifies the importance of public well-being within the government’s overall strategic objectives, aiming to improve the health infrastructure. These changes were aimed to have a wide impact, reaching patients who require treatments for critical diseases.

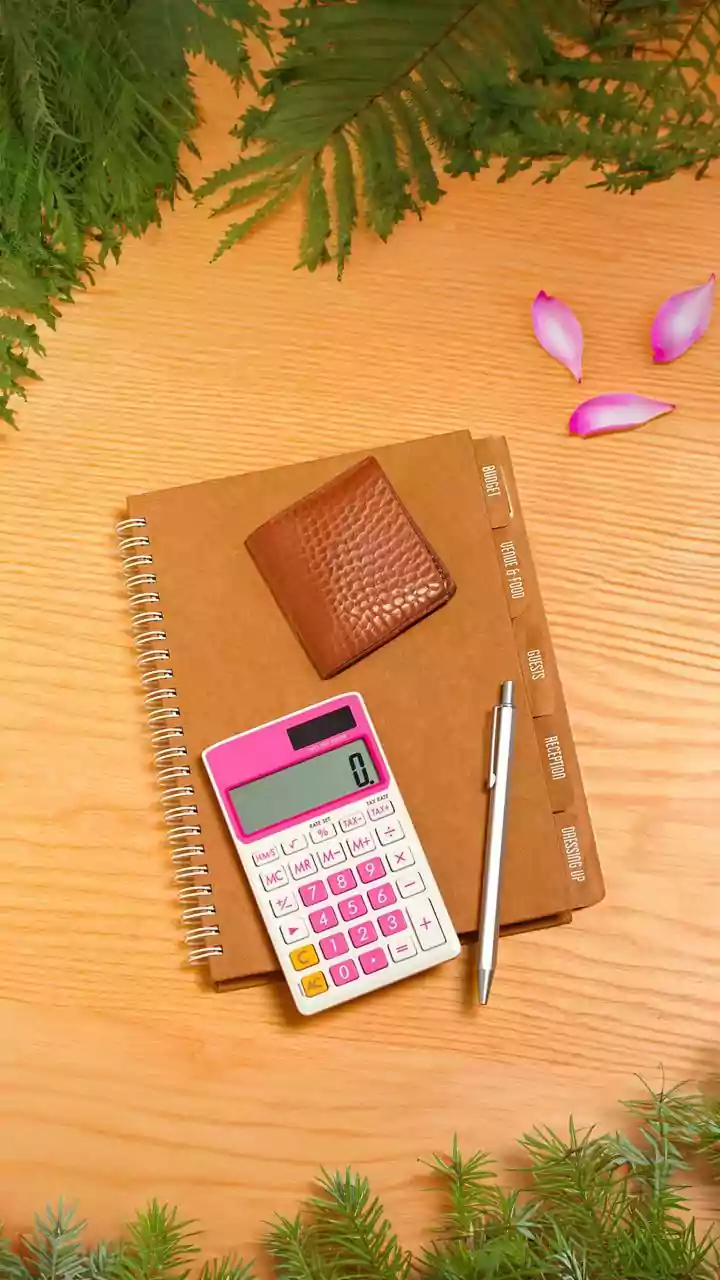

Taxation and Rebates

The budget also brought attention to personal finances, particularly concerning tax regimes. One key area was the Section 87A rebate limit under the new income tax regime for the fiscal year 2026-27. Although the exact details of the limit were not specified, this indicated that the government was continuing with its efforts to ease the tax burden on individuals. These changes provided insights into how the government planned to manage personal income taxes in the coming fiscal year, providing potential benefits for taxpayers. The announcements about tax slabs and rates under the new and old tax regimes will be essential for individuals to accurately manage their financial planning and obligations. The budget also showcased the government's fiscal strategy, which can influence savings and investments.

Defence Budget Increase

Beyond healthcare and personal finance, the Union Budget 2026 also focused on national security. A significant aspect of the budget was the substantial increase in the defence budget, which jumped to Rs 7.85 lakh crore. A notable portion of this, Rs 2.19 lakh crore, was earmarked for modernisation. This increase in defence spending reflected the government's commitment to enhancing national security and modernising the armed forces. It signaled an ongoing effort to strengthen India's defense capabilities through investments in new equipment and technologies. This budgetary allocation showed the government's commitment to ensuring the country's safety and strategic readiness. The Defence budget underscored the government's priorities and its approach to national security.

Market Reactions & Speeches

The budget's impact extended to the financial markets as well. On the day of the budget presentation, gold prices experienced a decline, while silver prices also saw a dip of 9%. These movements provided insights into how the market reacted to the budget announcements and economic forecasts. The presentation of the Union Budget 2026 was a significant event, with Nirmala Sitharaman delivering her speech. There was a look into the speeches, analysing the length of the speeches, revealing that they vary in duration. These aspects highlighted the multifaceted nature of the budget's influence, extending from specific sectors to the overall economic climate.