Fiscal Stability & Growth

The cornerstone of the 2026-27 budget is its emphasis on maintaining robust economic growth, with the Finance Minister prioritizing the economy's stability.

A key aspect of this involves setting fiscal targets and managing the nation's debt path effectively. The government anticipates receiving ₹3.16 lakh crore from the RBI as a dividend in FY27, which will contribute to managing the fiscal landscape. The budget also seeks to sustain an impressive 7-8% growth rate, reflecting a proactive approach towards economic development. The focus extends to sectors like infrastructure, as demonstrated by the increase in the pollution control budget, which will further support sustainable and balanced growth across various sectors. These measures underscore a commitment to prudent financial management and sustained economic expansion.

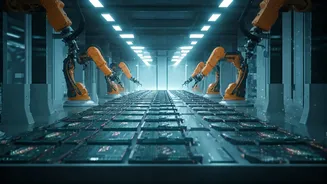

Boosting Manufacturing

The 2026-27 budget is strategically designed to bolster the manufacturing sector, aiming to enhance its contribution to the Indian economy. Several measures are included to encourage growth and competitiveness in this sector. Policy continuity is a key element, with the government signaling its commitment to consistent support for manufacturing. The budget also introduces specific provisions to boost the manufacturing sector through various incentives, aiming to create a favorable environment for businesses. The textile sector will experience a surge due to budget announcements, which will enhance the manufacturing sector's prospects. The focus on MSMEs (Micro, Small, and Medium Enterprises) is significant. This support is intended to empower smaller businesses and create jobs, thereby contributing to the overall economic growth and development in India.

Technology & Innovation

A significant facet of the 2026-27 budget is its strong emphasis on technology and innovation. The government views India as a future global tech leader and has introduced plans to support the sector's growth. The budget features an increased allocation for forensic schemes, totaling ₹1471 crore, underlining the government's commitment to technological advancements and forensic science. India's data center sector has received a boost, thanks to tax holidays and the establishment of GCC safe harbors, attracting investment. Discussions about an IT tax overhaul aim to reduce litigation and make India a prominent hub for information technology. These strategies highlight the budget's intention to foster innovation and technological progress, thereby propelling the nation toward economic leadership in the technology realm.

Sector-Specific Impacts

The 2026-27 budget delivers targeted impacts across various sectors, creating a ripple effect of growth and development. The cement industry benefits from the infrastructure push, which drives the demand for construction materials and supports economic activity. Similarly, the tyre industry is expected to thrive because of infrastructure development plans outlined in the budget. The logistics industry is also poised for growth, anticipating a positive impact from the budget's strategic provisions. The FMCG sector is poised for growth, focusing on MSMEs and rural expansion, which will boost consumption and drive economic activity. Furthermore, the dairy and cooperative sectors are expected to benefit, as the budget creates an ecosystem to support these critical areas. These sector-specific strategies indicate a holistic approach toward economic advancement, where individual areas support the collective growth of the Indian economy.

Investment & Tax Reforms

The budget strategically focuses on reforms that boost investment, attracting both domestic and foreign capital. One notable area is the potential increase in FDI (Foreign Direct Investment) in public sector banks, which could rise to 49%. The aim is to strengthen these banks and bring in global best practices. Additionally, the government has raised the duty-free limit to ₹75,000, promoting international trade and consumer spending. Another key proposal in the budget is the home loan interest deduction for FY27, which aims to support the real estate sector and provide relief to homebuyers. Tax reforms play a pivotal role, with the objective of reducing litigation and simplifying the tax process. These initiatives reflect the government's comprehensive approach to attract investments, promote financial inclusion, and accelerate economic growth.