Tax Cuts Announced

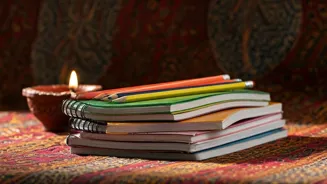

During the 56th GST Council meeting, Finance Minister Nirmala Sitharaman announced a welcome change. Many stationery items previously taxed at 12% are

now exempt. This decision, effective from September 22nd, aligns with the start of Navaratri, offering a festive boost to families. Key items like notebooks, pencils, and crayons are now tax-free.

Items Now Exempt

The list of tax-exempt items is extensive. It includes notebooks, pencils, crayons, erasers, maps, charts, globes, and graph books. Also included are drawing charcoal and tailor’s chalk. This means everyday essentials for students of all ages become more affordable, a practical step for supporting education across India. Even pencil sharpeners are now exempt.

Impact on Families

This reduction brings direct savings for families. For families, even this reduction in recurring education expenses adds up significantly across years of schooling. This measure aligns perfectly with the focus on improving education accessibility and reducing financial strain. This is a big win for parents, making education a bit more affordable during these times.

School and Curriculum Boost

The move benefits schools by freeing up resources. Schools can now direct funds toward curriculum, teacher training, and better infrastructure. This change empowers educators, and allows them to provide a better experience. This also makes educational resources like maps and charts more accessible to students. “For schools, it frees up resources that can be directed towards better curriculum, teacher training, and classroom infrastructure.”

Broader GST Reforms

The GST Council approved a new two-tier tax system. The structure streamlines the indirect tax structure into a dual slab of 5% and 18%. The 12% and 28% brackets were eliminated. All drugs and medicines have been assigned a concessional GST rate of 5%. This wider reform also ensures a smoother financial system within the Indian educational landscape, especially in the long run.