AI's Broadening Impact

The software sector is experiencing a widespread downturn, with analysts from JPMorgan noting that the impact of AI's rapid advancement is now felt across

all company sizes, from large-cap to small-cap. Previously considered less vulnerable to AI disruption, many software companies are now facing significant pressure. This intensified selloff indicates that AI's influence is extrapolating in ways that are both logical and, at times, seemingly illogical, affecting a broad spectrum of businesses and creating a scenario where 'there's nowhere to hide' for software stocks. This marks a stark contrast to earlier tech downturns where Indian IT stocks showed resilience. The recent market crash, exacerbated by the launch of new AI tools, highlights a growing concern about escalating competition and the potential for AI to fundamentally alter the software landscape.

The 'SaaSpocalypse' Phenomenon

Market observers are now referring to the current market turmoil in the software-as-a-service (SaaS) sector as the 'SaaSpocalypse.' This term reflects the significant fear and 'get me out' selling sentiment prevalent among traders. The core concern is that advanced AI capabilities, particularly AI agents, have the potential to completely dismantle existing SaaS business models. Many traditional SaaS products rely on 'workflow lock-in,' a concept that AI may render obsolete by providing more efficient, end-to-end solutions. This emerging consensus suggests that investor anxieties are well-founded, even if the market's pricing of this risk is not uniform across the entire sector. The potential for AI to significantly disrupt revenue models and product strategies is a critical point of discussion for market analysts and investors alike.

AI Agents Disrupting Workflows

The root of the current market anxiety lies in the rapid evolution of general-purpose AI agents. These agents are increasingly capable of executing entire workflows from start to finish, directly challenging the efficacy of existing software solutions. This development raises serious questions about the long-term viability of business models that depend on lengthy development cycles, linear headcount expansion, or simple feature enhancements. Investors are now reassessing growth projections for companies reliant on these traditional approaches. Specifically, Indian technology firms heavily involved in application maintenance, testing, support services, and basic SaaS functions like document processing or compliance management are considered more vulnerable to pricing pressures, reduced license agreements, and slower growth as enterprises adopt AI-powered productivity tools.

Indian IT at a Crossroads

While the risk of AI disruption is not being uniformly applied across the entire technology ecosystem, analysts believe the transition could prove more challenging for Indian IT companies compared to previous automation or cloud adoption cycles. This heightened risk is attributed to the unprecedented speed at which AI capabilities are advancing. Enterprises are indicating a shift in budget allocation, prioritizing outcomes, speed, and platform efficiency over increased manpower. This trend is expected to lead to compressed billing rates, shorter sales cycles, and reduced earnings visibility, factors that typically result in aggressive stock market penalties. The current market volatility is seen as a temporal mismatch, where long-term structural risks are being priced into near-term valuations before new operating models are fully established. For Indian IT firms, this period is less about becoming irrelevant and more about navigating margin compression, growth deceleration, and multiple pressures during a prolonged adjustment phase, suggesting a continued downside risk until clear adaptation strategies emerge.

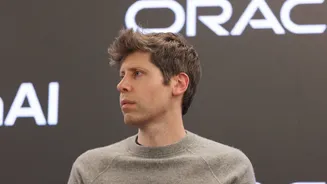

Zoho CEO's Perspective

Sridhar Vembu, Founder and CEO of Zoho, has expressed a negative outlook on the future of SaaS companies in the era of AI-assisted code development. He has long maintained that the SaaS industry was ripe for consolidation, pointing to business models that prioritized sales and marketing over engineering and product development as inherently vulnerable. Vembu views the venture capital and stock market bubbles as having sustained an unsustainable model for too long, and he sees AI as the catalyst that is now deflating this inflated market. He emphasizes the need for companies like Zoho to constantly adapt and contemplates the possibility of failure to foster a more fearless approach to strategic planning. The recent market downturns, triggered by AI advancements like Anthropic's legal tool, are seen as evidence of this impending disruption.

Anthropic's AI Advance

The launch of plug-ins for Anthropic's Claude AI chatbot, enabling automation across legal, sales, marketing, and data analysis, has intensified investor concerns about AI-driven competition for software makers. This development has reignited worries of a significant disruption within the data and professional services industries, sectors previously considered strong beneficiaries of the AI revolution. Analysts, including those at Morgan Stanley, view these new capabilities as a direct sign of escalating competition and a potential negative for software firms. The market reaction has been swift and severe, with major tech stocks like Nvidia, Microsoft, Alphabet, and Amazon experiencing declines. Furthermore, prominent software companies such as Salesforce and Adobe saw their share prices drop significantly, with Freshworks experiencing a particularly sharp crash of 10 percent, underscoring the broad impact of these AI advancements on investor sentiment.