Nifty's Bullish Outlook

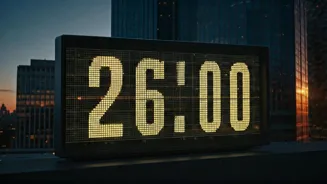

The article's central theme revolves around the Nifty's potential to reach 26,000. This target is not just a number; it signifies a significant shift in

market sentiment. A successful breakout at a crucial point could ignite positive investor feelings. The discussion will probably assess the critical levels that the Nifty must overcome to achieve this milestone, exploring technical analysis concepts and the broader market environment. The narrative would provide valuable insights to investors looking to understand the dynamics of the Indian stock market, specifically concerning the Nifty index and its ability to sustain growth.

Breakout's Sentiment Boost

A 'crucial breakout' is highlighted as a pivotal event that could drastically enhance market sentiment. Such a breakout suggests that the Nifty is successfully moving beyond resistance levels. This can lead to an influx of new investments. The article would probably highlight the specific levels that represent the breakout point, probably suggesting the areas that traders and investors should monitor. The significance of this event is due to the potential to spark a cascade of positive effects, including increased trading activity, the entry of new participants, and an overall sense of optimism.

Sudeep Shah's Insights

Sudeep Shah, a key figure in the discourse, likely offers expert insights into the market. His viewpoint will probably give readers a deeper understanding of how current events, economic indicators, and market data are shaping the Nifty's trajectory. The analysis will probably include predictions, recommendations, and key points to observe for those looking to capitalize on market movements. Shah's insights will offer a perspective grounded in experience and a thorough understanding of the forces influencing the Indian stock market. It offers readers the benefit of a seasoned expert's knowledge, helping them make better informed financial choices.

Market's Broader Context

The broader market context is essential for interpreting the Nifty's potential. Elements like the performance of various sectors, the flow of foreign investment, and general investor sentiment will have a major impact. The report would probably examine the performance of other market indicators to deliver a complete understanding of the environment. This would allow investors to see how the Nifty fits into the overall financial landscape. The emphasis is on providing a complete and well-rounded perspective, which will allow readers to evaluate opportunities and risks effectively within the market.

Investor Implications

The report aims to provide a summary of what the Nifty's possible upward movement implies for investors. A rising index could trigger a rise in investment portfolios, especially those geared toward index funds or stocks within the Nifty. Understanding this context empowers investors to make tactical adjustments to their strategies. The piece may also discuss risk management, offering advice on how to protect investments during market volatility. The ultimate goal is to arm investors with the information and guidance required to effectively manage their portfolios. The article provides information about the Nifty's progress, which ultimately helps investors to achieve financial success.