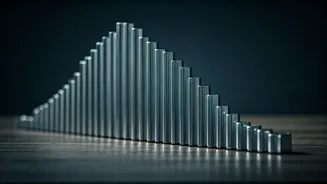

Market's Downward Slide

The market has recently exhibited a notable downward trend. The Nifty, a key indicator of market performance, has fallen below the 25,400 mark, signaling

a significant shift in investor confidence. This decline is not isolated; the BSE Midcap and Smallcap indices also experienced substantial drops, both cracking by 2%. These simultaneous declines highlight a broader pattern of market correction, impacting various sectors and investor portfolios. The overall sentiment reflects increasing cautiousness among traders and investors, influencing the trajectory of the market.

Tech Stocks Under Pressure

Tech stocks are currently facing considerable pressure, contributing significantly to the market's decline. The Nifty IT index experienced a 1.5% decrease, demonstrating the vulnerability of the technology sector to current market dynamics. Furthermore, LTIMindtree saw a substantial plunge of 7%. These figures highlight that specific tech companies and the IT sector are experiencing a pronounced downturn. Several factors influence tech stocks, including changes in investor confidence, broader economic trends, and performance results. Understanding these variables provides critical insights into the present market behavior.

Factors Contributing Decline

Multiple factors contribute to the market's current downward trajectory. These elements include shifts in investor sentiment influenced by global economic data, interest rate decisions, and geopolitical tensions. Other elements involve sector-specific challenges, such as developments within the technology industry and changing consumer demands. The overall economic landscape, combined with company-specific results, plays a crucial role in shaping market behavior. Investors' reactions to these various influencers drive the volatility observed in the market. Analyzing these contributing factors offers a more complete picture of the current market scenario.

![[WATCH] 'Real Madrid, Ramadan and rest' - Mohammed Siraj how last-minute World Cup call-up changed February plan](https://g-mob.glance-cdn.com/public/fc/image/ByYT_LEmlrD0.webp)