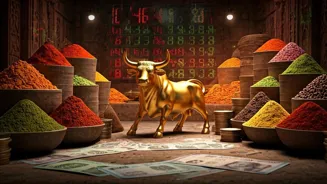

With GST 2.0 in play, the Indian market is witnessing shifts. This piece breaks down the market's reaction, crucial stock trends, and sector-specific impacts,

offering insights for every Indian investor.

Market Trends Unveiled

The GST reforms have triggered immediate reactions in the stock market. Several stocks are experiencing shifts in valuation. This article offers insights into gainers like M&M and the ancillaries, alongside losers like Bata India and others. Stay updated on the current market landscape.

Sector-Specific Impacts

The article highlights the impact of the revised GST rates on various sectors. From the automobile industry to the electronics sector, the changes affect multiple businesses. Learn how these shifts could influence your investment decisions in sectors like chips and cars, directly impacting Indian consumers.

Investment Strategies

With these reforms, smart investment strategies become vital. Explore investment ideas and tools to navigate the changing market landscape. Understand how market movements can offer potential opportunities while carefully considering the risks and future prospects in the Indian market.

Key Stock Performance

The article showcases the performance of key stocks, detailing both top gainers and top losers. This includes stocks like UNO Minda, Samvardhana Motherson International and more. Analyze these trends to help refine your portfolio and align with the changes in the Indian business landscape.

Future Outlook

The GST reforms are timely, and their impact will be felt over time. The article provides a glimpse into future market prospects. It guides investors on how to stay informed and adapt to the changing economic environment, including strategies to invest wisely in the Indian market.