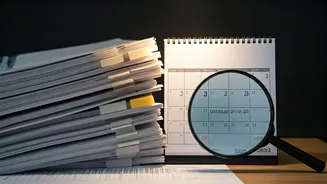

Deadline Extension Details

The CBDT adjusted the deadline, granting an extension to taxpayers and businesses. The initial date of September 30th, 2025, has been moved to October

31st, 2025. This allows more time for completing audits and filing reports. This extension is a helpful move, especially considering the complexities involved in tax audits. It gives professionals and businesses the opportunity to ensure accuracy and thoroughness in their submissions, aligning with the end-of-year accounting procedures.

Who Needs To Comply?

This extension primarily concerns those required to get their accounts audited under the Income Tax Act. Generally, if a business's turnover exceeds the prescribed limit, a tax audit becomes mandatory. Likewise, certain professionals and individuals with specific income levels also need to comply. The audit involves a chartered accountant reviewing financial statements to ensure they meet tax regulations. Therefore, the extension is important for any business or individual falling within these criteria, allowing them to finalize their documentation accurately and in good time.

Why The Extension?

The extension gives tax professionals and businesses some breathing room. It's likely the CBDT considered the difficulties that come with audits and the need for precision. By providing a longer timeframe, the government helps facilitate more accurate and complete filings. This extension helps promote a smoother tax filing process. This extended time period is especially helpful for those dealing with complex financial records. Ultimately, this move aims to foster greater accuracy and efficiency within the Indian tax system.

Avoiding Penalties & Filing

Missing the deadline could lead to penalties, as stated in the Income Tax Act. These penalties can include monetary fines. Therefore, it's important for businesses and individuals to complete their audits and file their reports promptly. The extended date is October 31st, 2025. Ensure all the needed paperwork is submitted before this time. Consulting with a tax advisor or chartered accountant is recommended to guarantee compliance with the regulations and to navigate any specific queries efficiently. This proactive strategy is vital for avoiding potential penalties and maintaining good standing with the tax authorities.