Market's Negative Shift

On a Tuesday morning, HCL Technologies' stock value encountered a downturn, a trend observed in the late morning trading. The market's shift prompted scrutiny

from analysts and investors, who then started analyzing the possible reasons behind the decline. This period marked a critical juncture, where stakeholders assessed the performance and its future implications. This was the initial market reaction after the release of the Q3 results. The decline triggered a series of evaluations and adjustments in investor strategies, leading to a ripple effect across the broader market. This situation showcased the volatility inherent in technology stocks, which are sensitive to economic indicators.

Brokerage Analysis Insights

The decline in HCL Technologies' share price sparked various views from financial experts, with brokerages weighing in to provide market analysis and offer perspectives. These institutions often evaluate a stock's value by assessing its past performance, current financials, and future growth prospects. The analysis from these brokerages plays a significant role in influencing investor sentiment and their trading behaviors. Their recommendations and target prices offer insights to assist investors in navigating market volatility. The views from the brokerages provide a comprehensive view of the company and its future directions. These factors become even more important as investors consider potential investment strategies. The analysis is very crucial for understanding the immediate and long-term consequences of the share price dip.

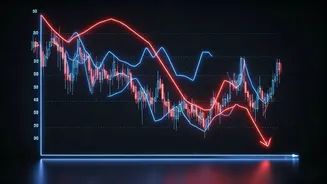

Technical Perspective Overview

The technical view of HCL Technologies' stock involves evaluating its price movements and trading volumes via charts and indicators. This process allows analysts to identify trends, support and resistance levels, and potential buying or selling signals. Charts are helpful tools for understanding the immediate market sentiment, offering visual representations that investors use to make decisions. The technical view is instrumental in predicting future price movements by studying historical data. These technical analysis tools help investors assess the stock's behavior, allowing them to gauge entry and exit points. Moreover, it complements fundamental analysis to provide a well-rounded strategy for managing investment decisions. This approach enables a more thorough evaluation of the company's financial performance.

Investor Decision Framework

Given the share price decline following the Q3 results, investors need to formulate informed decisions. The primary step involves a careful review of the company's financial statements to assess the reasons behind the stock's negative movement. Investors should evaluate their existing holdings and consider whether to adjust their positions. The analysis helps investors determine if the stock's current price accurately reflects its long-term value. Investors can determine whether the decline is a temporary market fluctuation or a sign of deeper issues. Further assessment could involve consulting financial advisors or conducting additional research. By combining insights with a long-term investment approach, investors can make prudent decisions. Investors should always evaluate their risk tolerance and financial goals.